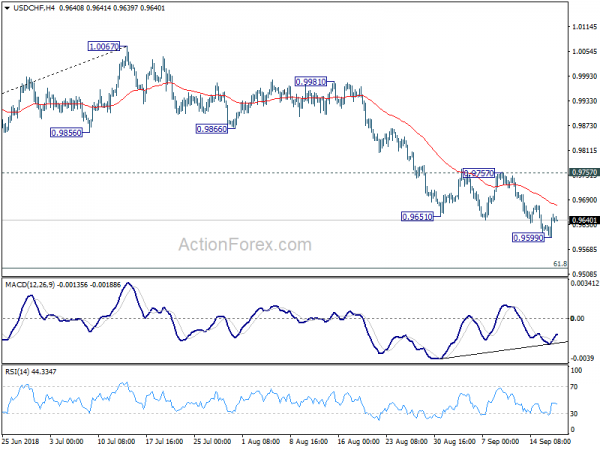

Daily Pivots: (S1) 0.9611; (P) 0.9634; (R1) 0.9669; More…..

USD/CHF recovered after hitting 0.9599 and intraday bias is turned neutral again. As long as 0.9757 resistance holds, deeper decline is expected. Break of 0.9599 will target 0.9523 fibonacci level next. Considering bullish convergence condition in 4 hour MACD, downside will likely be contained by 0.9523 to bring rebound. On the upside, break of 0.9757 will suggests that fall from 1.0067 has formed a short term bottom. In such case, further rise would be seen back to 55 day EMA (now at 0.9809).

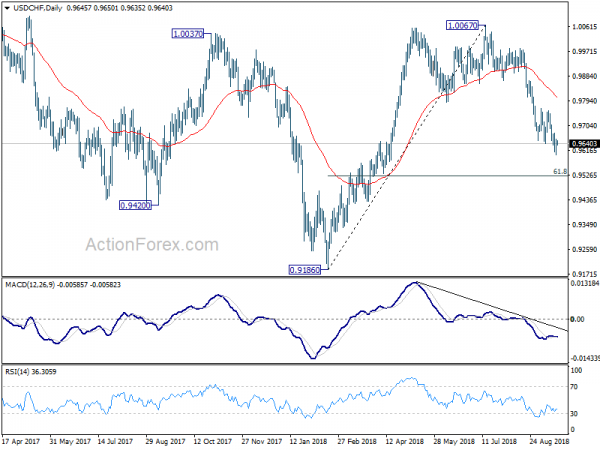

In the bigger picture, rise from 0.9186 low has completed at 1.0067, after failing to sustain above 1.0037 resistance. Fall from 1.0067 could extend to 61.8% retracement of 0.9816 to 1.0067 at 0.9523 and below. But for now, we don’t expect a break of 0.9186 low. On the upside, firm break of 0.9866 support turned resistance will suggests that fall from 1.0067 has completed and rise from 0.9186 is resuming.