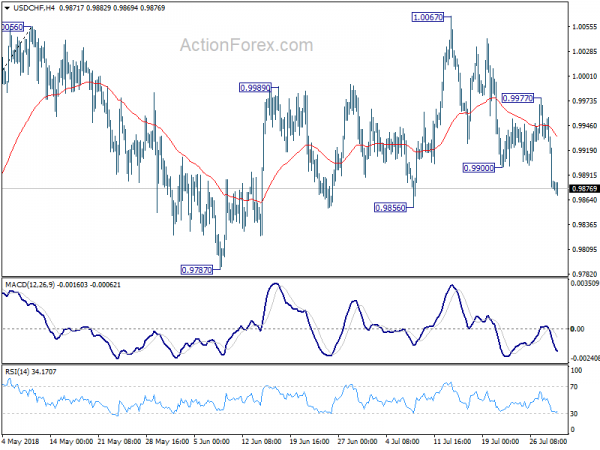

Daily Pivots: (S1) 0.9854; (P) 0.9906; (R1) 0.9934; More…

The break of 0.9900 support indicates resumption of fall from 1.0067. Intraday bias is turned to the downside for 0.9856 support first. Break will target 0.9787 and below. For now, USD/CHF is seen as in consolidation from 1.0056 with fall from 1.0067 as the third leg. Downside should be contained by 38.2% retracement of 0.9186 to 1.0056 at 0.9724 to bring rebound. On the upside, break of 0.9977 resistance is needed to indicate completion of the decline. Otherwise, near term outlook is mildly bearish in case of recovery.

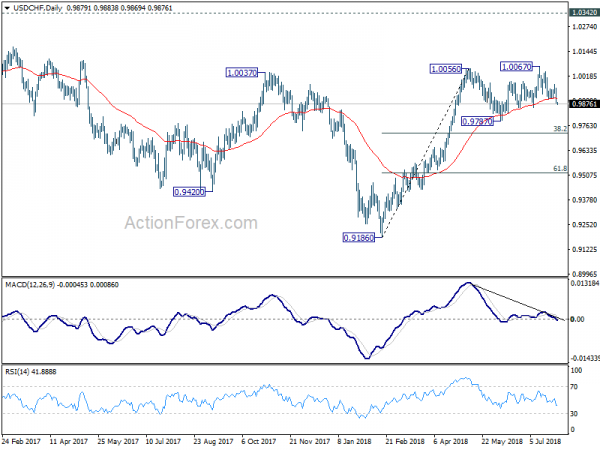

In the bigger picture, current development suggests that the consolidation pattern from 1.0056 is extending with another leg. As long as 38.2% retracement of 0.9186 to 1.0056 at 0.9724 holds, we’d expect rise from 0.9186 to resume at a later stage to retest 1.0342 key resistance (2016 high). However, sustained break of 0.9724 will bring deeper fall, as another declining leg in the long term range pattern.