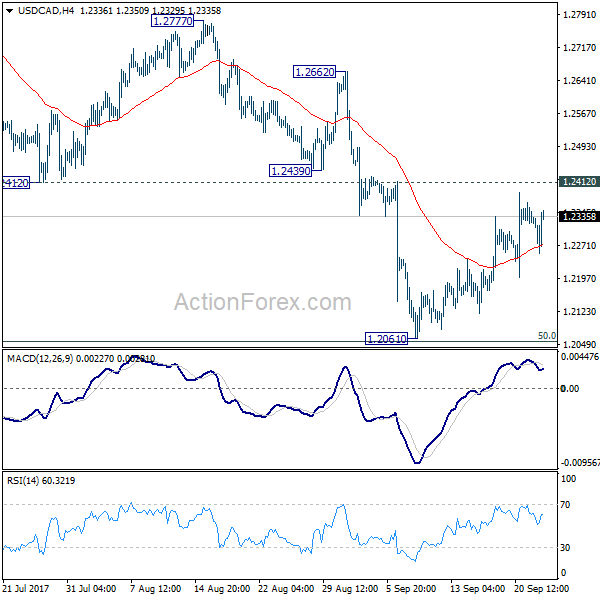

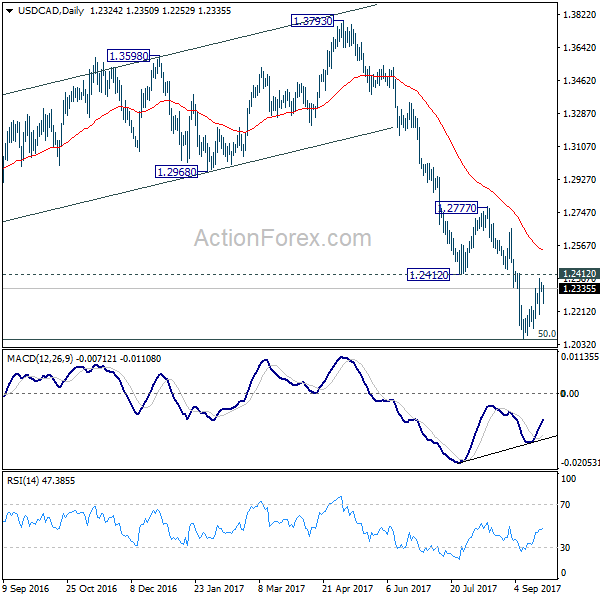

USD/CAD edged higher last week and consolidation from 1.2061 extended. Overall outlook is unchanged though. Initial bias remains neutral this week first. We’d remain cautious on strong support from 1.2048 to bring sustainable rebound. But still, break of 1.2439 support turned resistance is needed to be the first sign of trend reversal. Otherwise, outlook will remain bearish. Firm break of 1.2048 will pave the way to next fibonacci level at 1.1424. Break of 1.2412 will bring stronger rise back to 55 day EMA (now at 1.2538) and above.

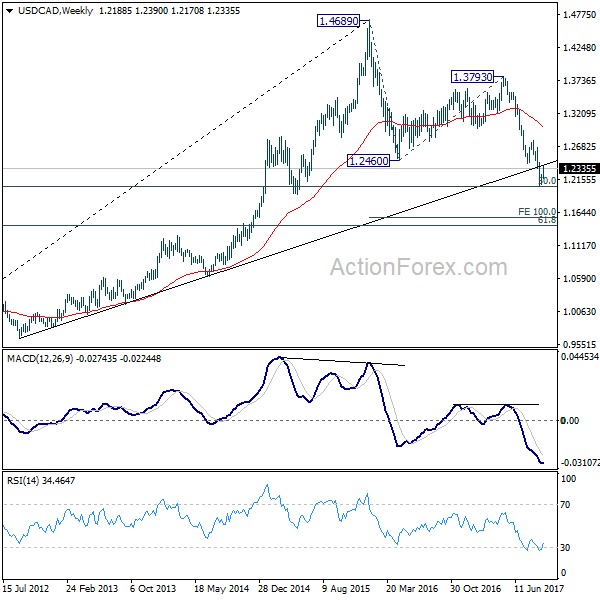

In the bigger picture, focus remains on 50% retracement of 0.9406 to 1.4869 at 1.2048. As long as this level holds, we’d still favor that case that fall from 1.4689 is a correction. Rebound from 1.2048 could extend the larger up trend from 0.9406. However, firm break of 1.2048 will indicate that fall from 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.

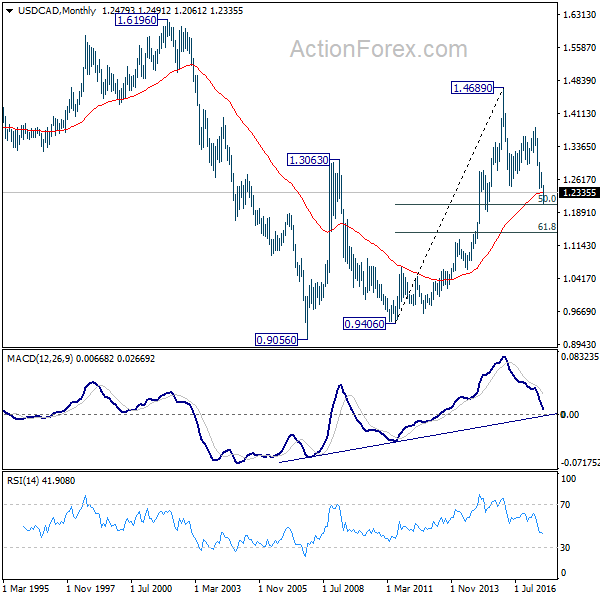

In the longer term picture, the long term outlook is turned a bit mixed with the current downside acceleration. As noted above, 50% retracement of 0.9406 to 1.4869 at 1.2048 is a key level to determine whether up trend from 0.9056 (2007) has already completed.