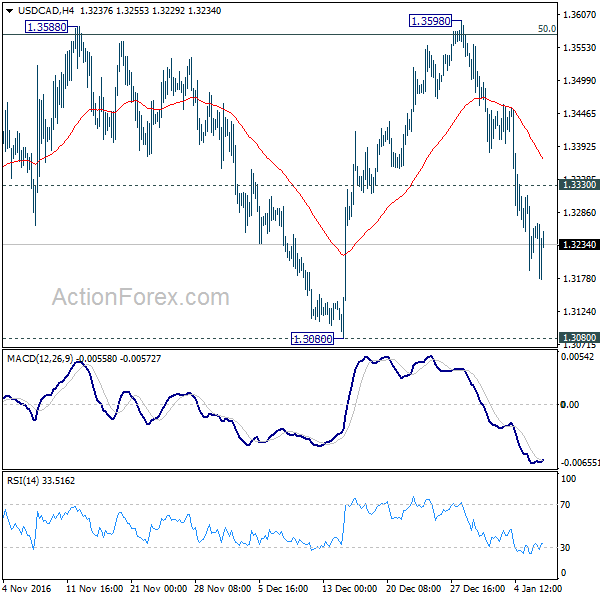

USD/CAD’s fall from 1.3598 extended to as low as 1.3176 last week. Initial bias stays on the downside this week for 1.3080 support next. As noted before, price actions from 1.2460 are viewed as a corrective move. Decisive break of 1.3080 will indicate that it’s completed and turn outlook bearish for retesting 1.2460 low. On the upside, above 1.3330 minor resistance will turn bias neutral again with focus back on 1.3588/98 resistance zone.

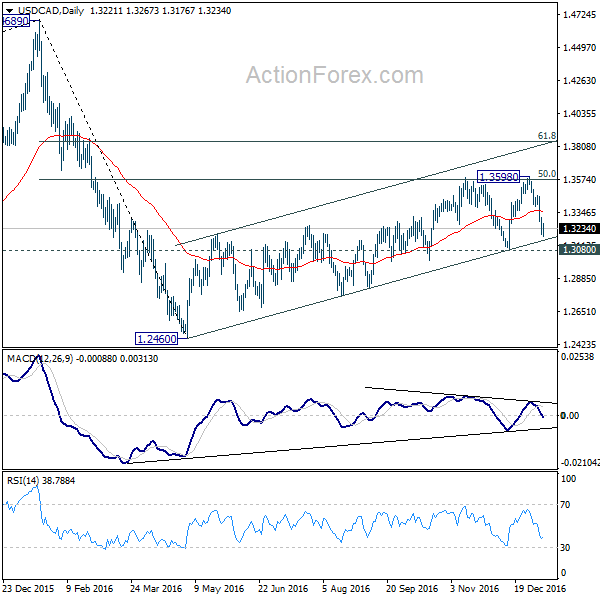

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is possibly finished at 1.3598 too after hitting 50% retracement of 1.4689 to 1.2460 at 1.3575. Break of 1.3080 would likely resume the fall from 1.4689 through 1.2460 to 50% retracement of 0.9406 to 1.4689 at 1.2048. We’d start to look for reversal signal below 1.2460 to complete the correction. In case of another rise, we’ll look for topping sign at 61.8% retracement of 1.4689 to 1.2460 at 1.3838.

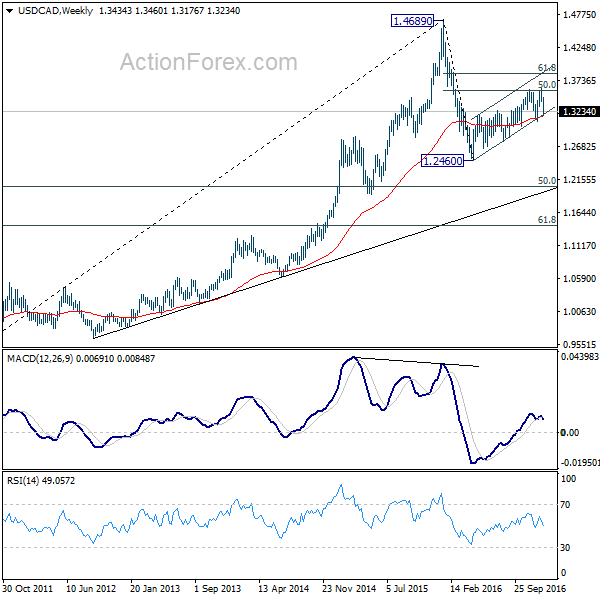

In the longer term picture, rise from 0.9056 (2007 low) is viewed as a long term up trend. It’s taking a breath after hitting 1.4689. But such rise expected to resume later to test 1.6196 down the road.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box