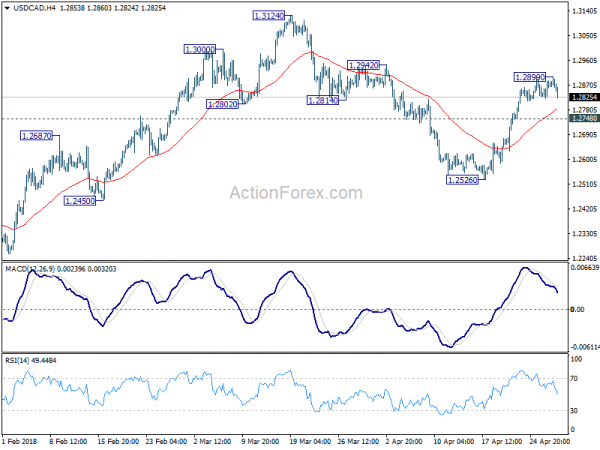

USD/CAD rebounded further to as high as 1.2899 last week before forming a temporary top there and retreated. Initial bias is neutral this week first and some consolidations could be seen. For now, decline from 1.3124 is seen as completed with three waves down to 1.2526. The corrective structure suggests that later rebound from 1.2061 is not completed. Hence, retreat from 1.2899 should be contained by 1.2748 minor support and bring another rally. Break of 1.2899 will target 1.3124 high. However, firm break of 1.2748 will turn focus back to 1.2526 support instead.

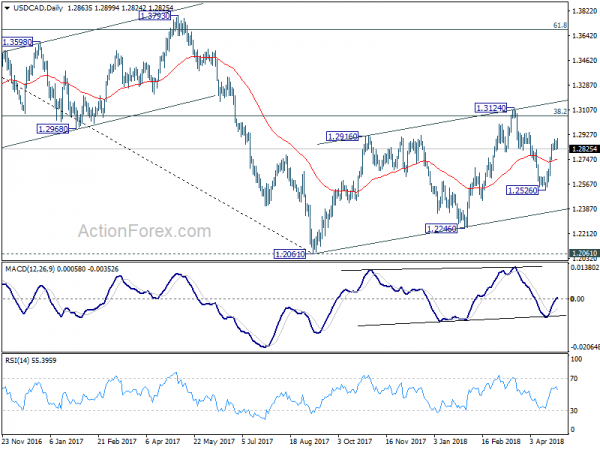

In the bigger picture, current development suggests that rebound from 1.2061 has not completed yet. Focus is back on 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Sustained trading above there will confirm medium term bullish reversal. That is, down trend from 1.4689 has completed at 1.2061 already. In that case, next target will be 61.8% retracement at 1.3685.

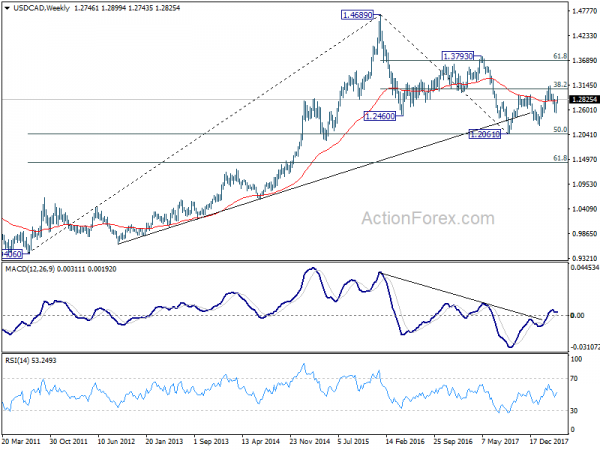

In the longer term picture, 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048 remains a key support level to watch. As long as this level holds, we’ll treat fall from 1.4689 as a correction and expect another rally through this level. However, sustained break of 1.2048 will turn favors to the case that rise from 0.9056 (2007 low) is a three wave corrective move that’s completed at 1.4689. And retest of 0.9056/9406 support zone could be seen in medium to long term.