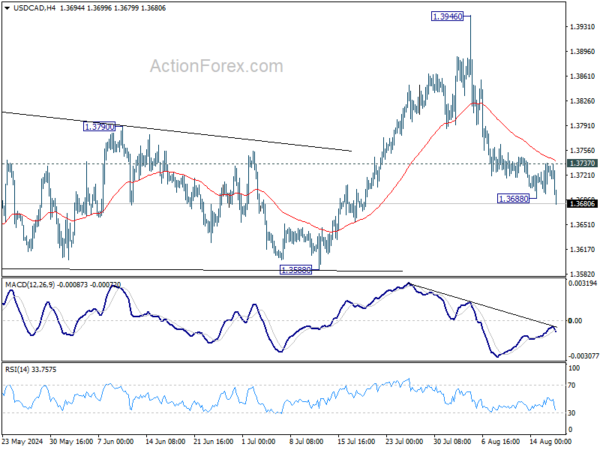

USD/CAD’s fall from 1.3946 short term top extended lower last week, and with the late break of 1.3688 temporary low, initial bias is back on the downside, Deeper decline should be seen to 1.3588 support. On the upside, above 1.3737 minor resistance will turn intraday bias back to the upside for stronger recovery.

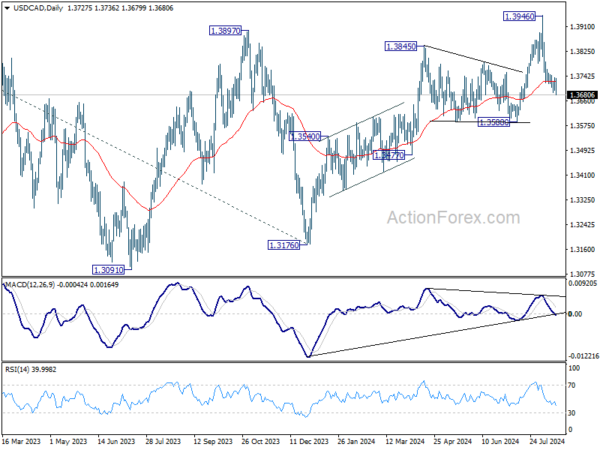

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern, that might have completed at 1.3176 (2023 low) already. Firm break of 1.3976 will confirm resumption of whole up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149. This will be the favored case as long as 1.3588 support holds, in case of pullback.

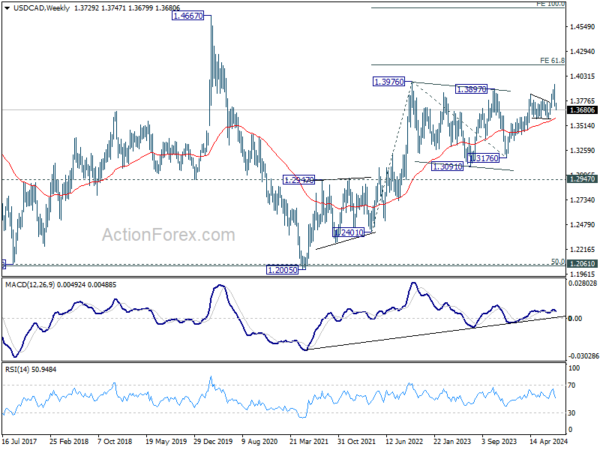

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as long as 1.2947 resistance turned support holds.