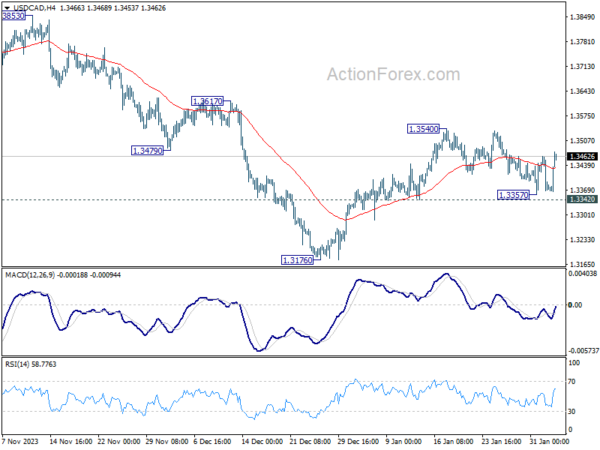

USD/CAD’s correction from 1.3540 extended lower to 1.3357 last week but recovered since then. Initial bias stays neutral this week first. On the upside, break of 1.3540 will resume the rise from 1.3176. That will also revive that case that whole fall from 1.3897 has completed. Nevertheless, firm break of 1.3342 support will argue that rebound from 1.3176 has completed at 1.3540, and target this low for resuming whole fall from 1.3897.

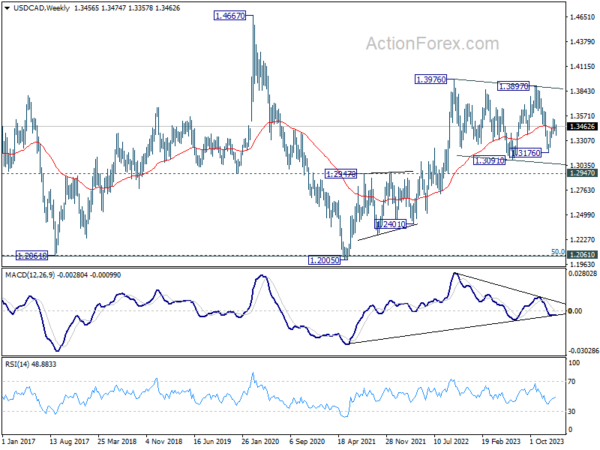

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern only. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Overall, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 at a later stage.

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as long as 1.2947 resistance turned support holds.