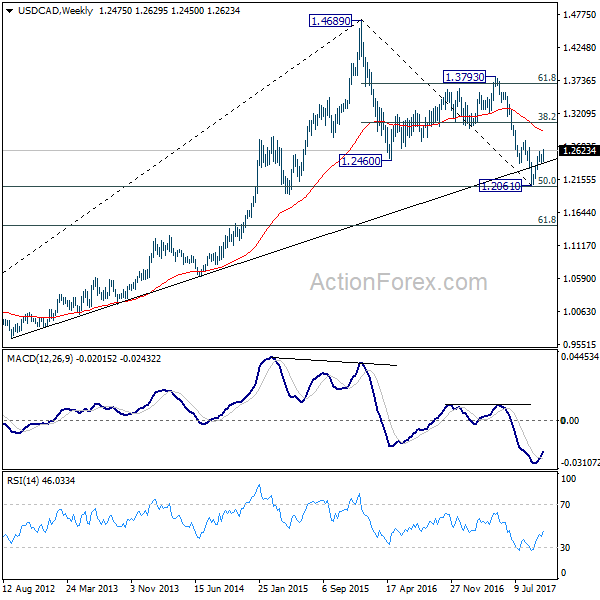

USD/CAD’s break of 1.2598 last week indicates that rebound from 1.2061 has resumed. Initial bias is back on the upside this week for 1.2777 resistance first. Decisive break there will confirm medium term reversal and target 38.2% retracement of 1.4689 to 1.2061 at 1.3065 next. On the downside, break of 1.2432 support is needed to indicate completion of the rebound. Otherwise, outlook will remain mildly bullish in case of retreat.

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4869 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Break of 1.2777 will further affirm this bullish case. That is, larger up trend from 0.9406 is not completed. And in that case, USD/CAD should target 1.3793 key resistance next. However, on the other hand, firm break of 1.2048 will indicate that fall from 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.

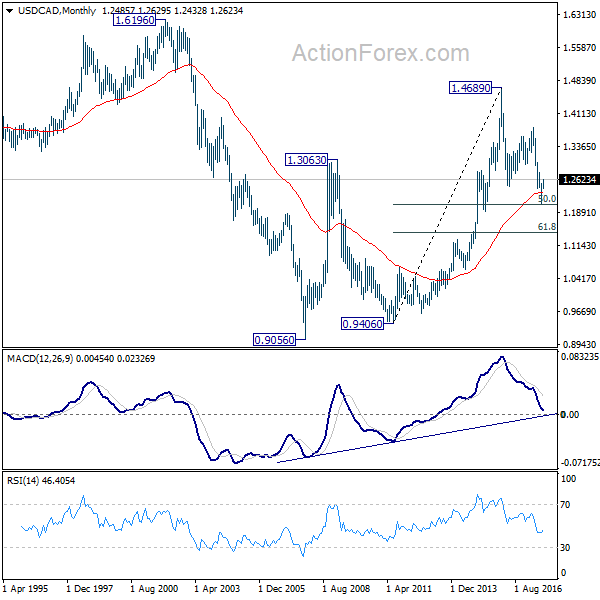

In the longer term picture, the long term outlook is turned a bit mixed. As noted above, 50% retracement of 0.9406 to 1.4869 at 1.2048 is a key level to determine whether up trend from 0.9056 (2007) has already completed.