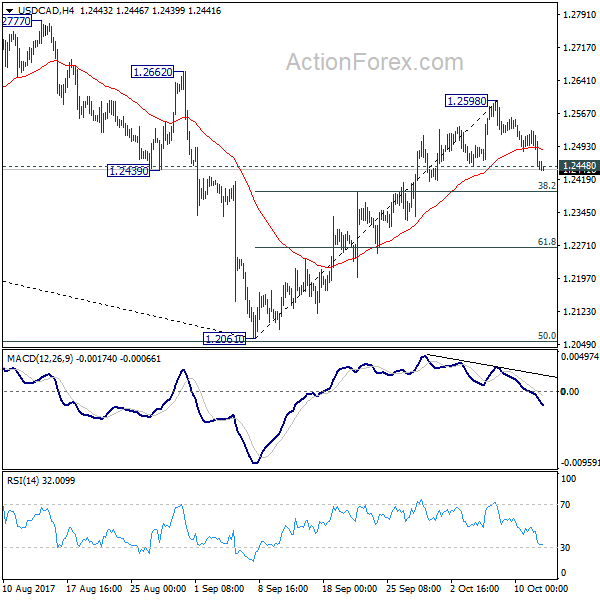

Daily Pivots: (S1) 1.2431; (P) 1.2481; (R1) 1.2509; More….

USD/CAD’s break of 1.2448 minor support suggest that a short term top is formed at 1.2598, after failing to sustain above 55 day EMA. Intraday bias is turned back to the downside for 38.2% retracement of 1.2061 to 1.2598 at 1.2393, or even further to 61.8% retracement at 1.2266. But we’ll look for bottoming sign below 1.2266. On the upside, break of 1.2598 will resume the rise from 1.2061 for 1.2777 resistance.

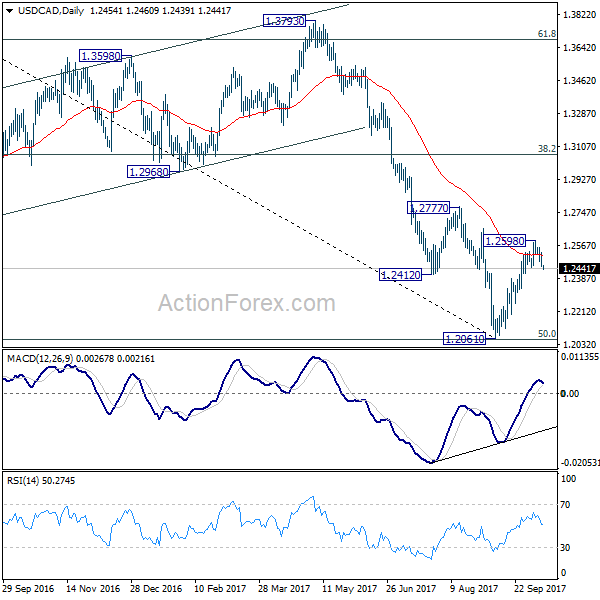

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4869 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Break of 1.2777 will further affirm this bullish case. That is, larger up trend from 0.9406 is not completed. And in that case, USD/CAD should target 1.3793 resistance next. However, on the other hand, firm break of 1.2048 will indicate that fall from 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.