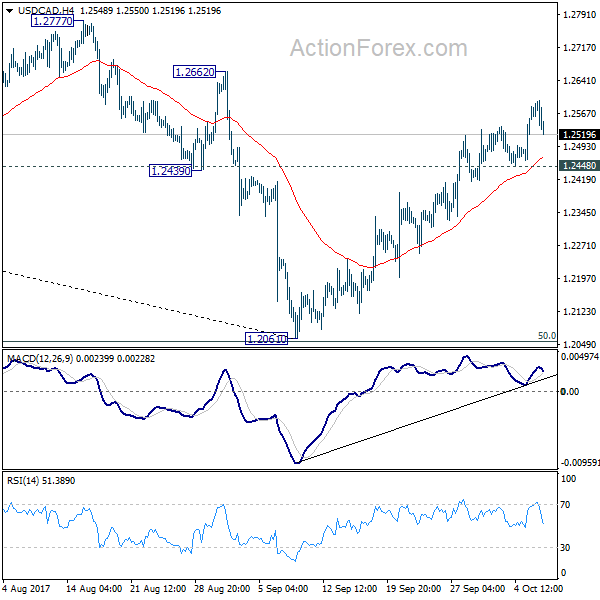

USD/CAD’s rebound from 1.2061 extended 1.2598 last week even though upside momentum isn’t convincing. As long as 1.2448 minor support holds, further rally is expected this week to 1.2777 resistance first. Decisive break there will target key medium term fibonacci level at target 38.2% retracement of 1.4689 to 1.2061 at 1.3065. On the downside, break of 1.2448 will indicate short term topping and turn bias back to the downside.

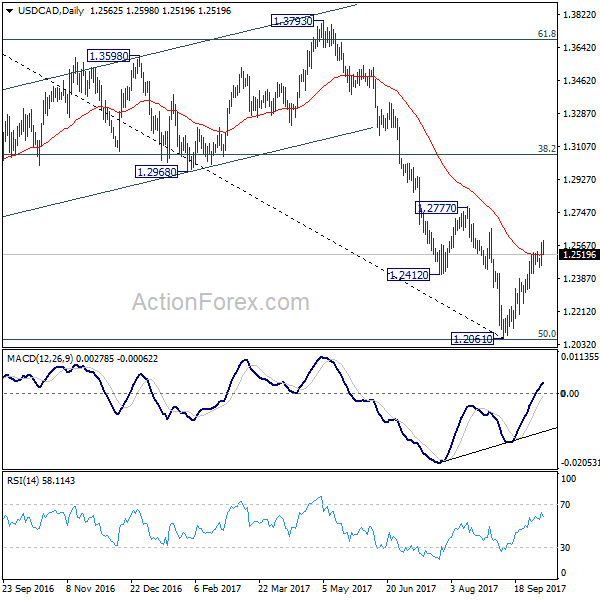

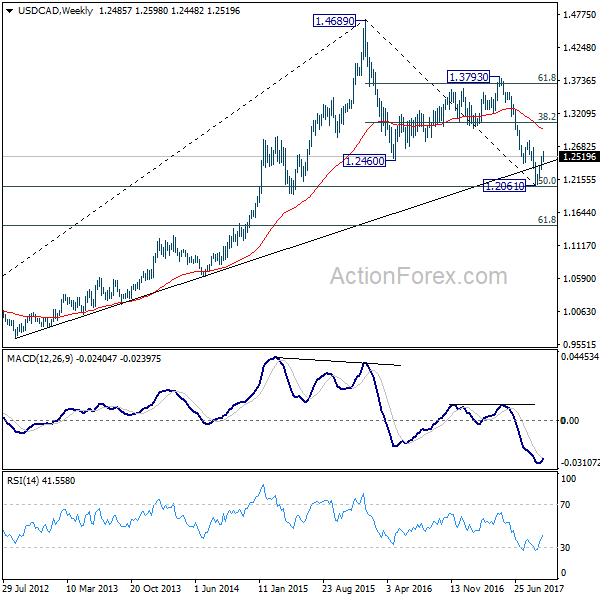

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4869 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Break of 1.2777 will further affirm this bullish case. That is, larger up trend from 0.9406 is not completed. And in that case, USD/CAD should target 1.3793 resistance next. However, on the other hand, firm break of 1.2048 will indicate that fall from 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.

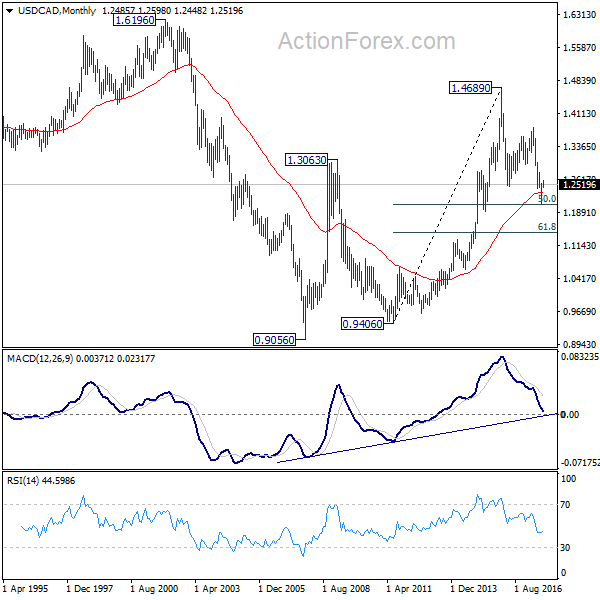

In the longer term picture, the long term outlook is turned a bit mixed. As noted above, 50% retracement of 0.9406 to 1.4869 at 1.2048 is a key level to determine whether up trend from 0.9056 (2007) has already completed.