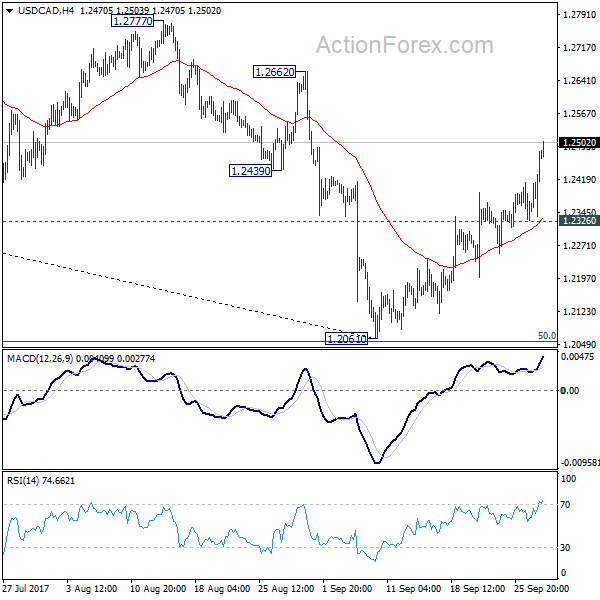

Daily Pivots: (S1) 1.2380; (P) 1.2431; (R1) 1.2528; More….

USD/CAD’s rebound from 1.2061 extended to as high as 1.2503 so far. The strong break of 1.2412 support turned resistance and upside acceleration carries bullish implications. The pair should have now successfully defended key long term fibonacci level at 2.1048. Near term outlook is turned bullish for 1.2777 resistance first. Decisive break there will target 38.2% retracement of 1.4689 to 1.2061 at 1.3065 next. And, this will be the preferred case as long as 1.2326 support holds.

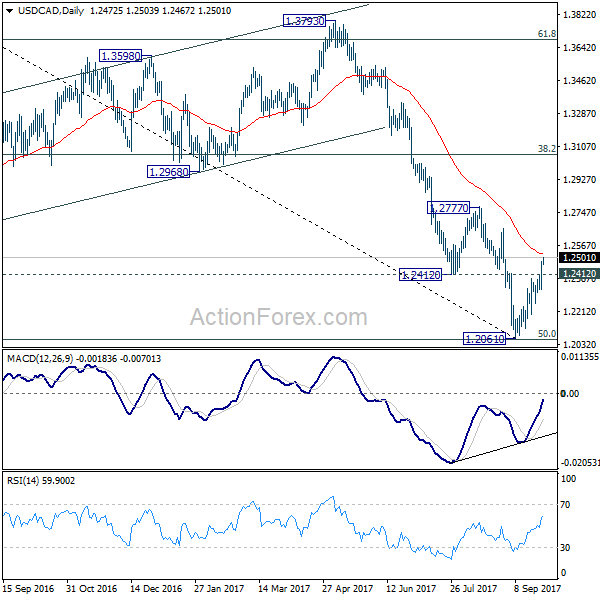

In the bigger picture, focus remains on 50% retracement of 0.9406 (2011 low) to 1.4869 (2016 high) at 1.2048. As long as this level holds, we’d still favor that case that fall from 1.4689 is a correction. Rebound from 1.2048 could extend the larger up trend from 0.9406. However, firm break of 1.2048 will indicate that fall from 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.