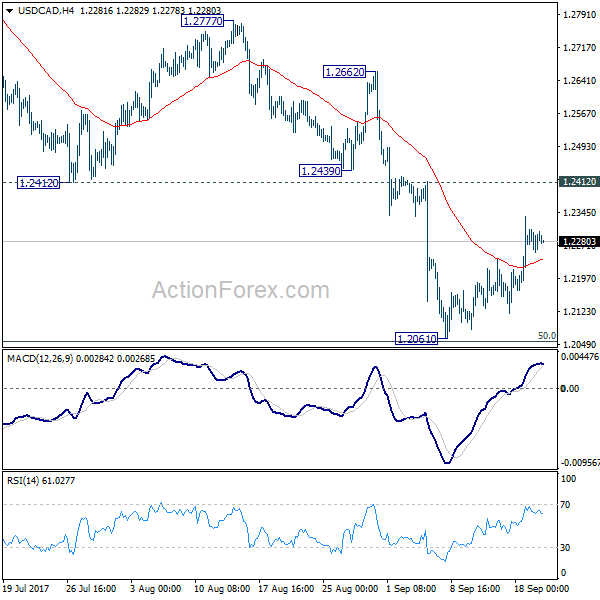

Daily Pivots: (S1) 1.2260; (P) 1.2284; (R1) 1.2314; More….

Intraday bias in USD/CAD remains neutral for the moment. On the one hand, we’d remain cautious on strong support from 1.2049 key fibonacci level to bring sustainable rebound. On the other hand, break of 1.2514 support turned resistance is needed to be the first sign of trend reversal. Otherwise, outlook will remain bearish. Firm break of 1.2049 key fibonacci level will pave the way to next fibonacci level at 1.1424.

In the bigger picture, current downside acceleration is raising the chance that whole long term rise from 0.9406 (2011 low), and that from 0.9056 (2007 low) is completed at 1.4689. Focus is now on 50% retracement of 0.9406 to 1.4869 at 1.2048. As long as this level holds, we’d still favor that case that fall from 1.4689 is a correction. However, firm break of 1.2048 will indicate that fall fro 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.