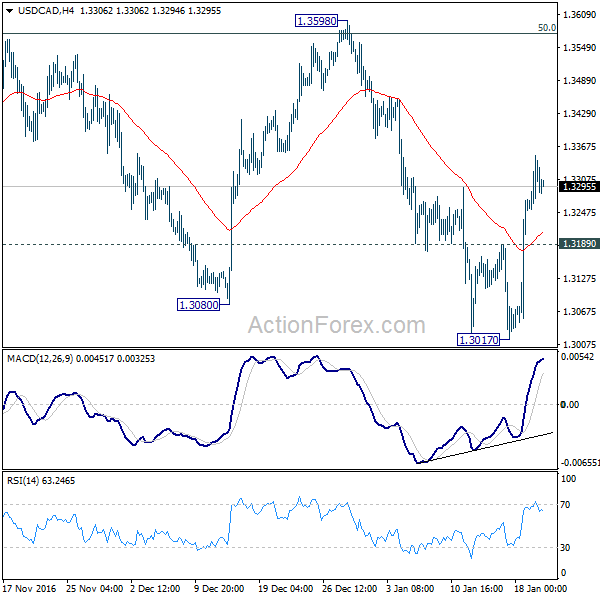

Daily Pivots: (S1) 1.3262; (P) 1.3307; (R1) 1.3363; More…

Current development suggests that the consolidation pattern from 1.3588 has completed with three waves to 1.3017. And, the corrective rise from 1.2460 hasn’t completed. Intraday bias is mildly on the upside for 1.3598 resistance. Break will target next fibonacci level at 1.3838. Meanwhile, break of 1.3017 will revive the case of near term reversal and target 1.2460.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. As rise from 1.2460 is seen as a corrective move, we’d look for reversal signal above 1.3838. Meanwhile, break of 1.3017 will likely start the third leg to 1.2460 and below.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box