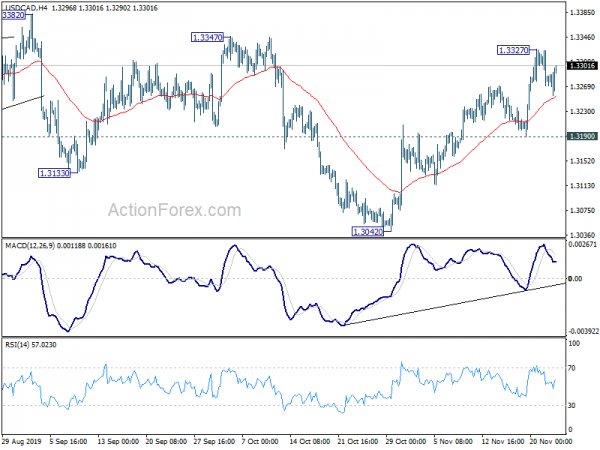

USD/CAD’s rally from 1.3042 extended to as high as 1.3327 last week before forming a temporary top there and retreated. Initial bias is neutral for some consolidations first. Downside should be contained by 1.3190 support to bring another rally. On the upside, break of 1.3327 will target 1.3347/82 resistance zone. Firm break there will suggest completion of consolidation from 1.3664. However, break of 1.3190 will indicate completion of the rebound and turn bias back to the downside for 1.3042 support.

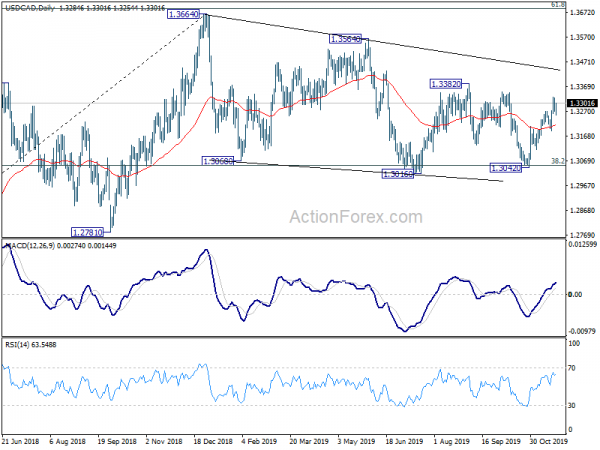

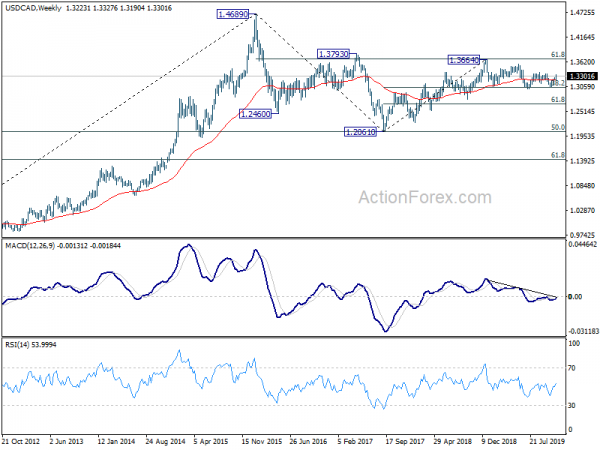

In the bigger picture, 38.2% retracement of 1.2061 to 1.364 at 1.3052 remains intact. Medium term rise from 1.2061 low is in favor to resume sooner or later. Firm break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will confirm and target 1.4689 high. However, sustained break of 1.3052 will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next.

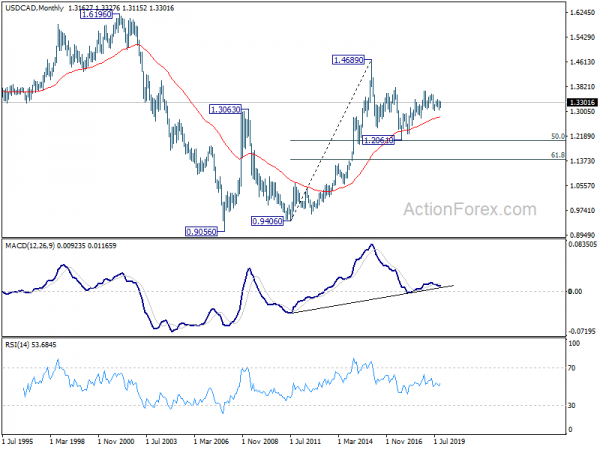

In the longer term picture, outlook remains unchanged that price actions from 1.4689 (2016 high) are forming a corrective pattern. As long as 1.2061 support holds. up trend from 0.9406 (2011 low) in in favor to resume through 1.4689 at a later stage.