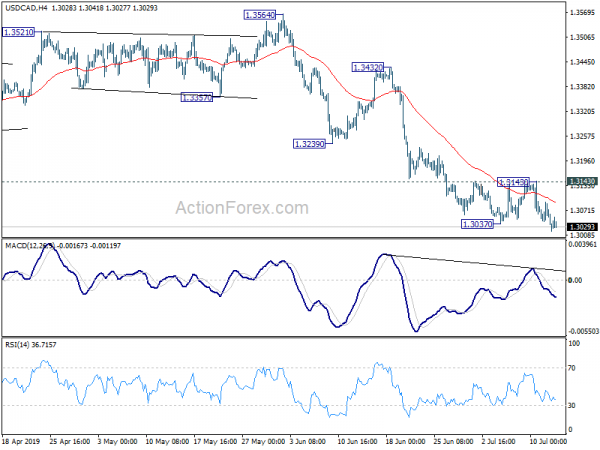

USD/CAD’s fall from 1.3564 resumed by breaking 1.3037 temporary low last week. Initial bias remains on the downside this week. Sustained trading below 1.3052/68 cluster support should confirm medium term reversal. Deeper decline should then be seen to 1.2781 support next. On the upside, break of 1.3143 resistance is needed to indicate short term bottoming. Otherwise, near term outlook will remain bearish in case of recovery.

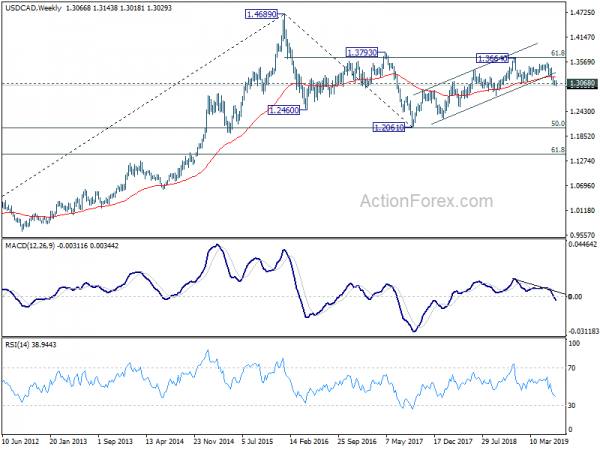

In the bigger picture, the case of bearish reversal continues to build up. Decisive break of 1.3068 cluster support (38.2% retracement of 1.2061 to 1.3664 at 1.3052) will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next. On the upside, sustained break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685, is needed to confirm resumption of up trend from 1.2061 (2017 low). Otherwise, risk will stay on the downside.

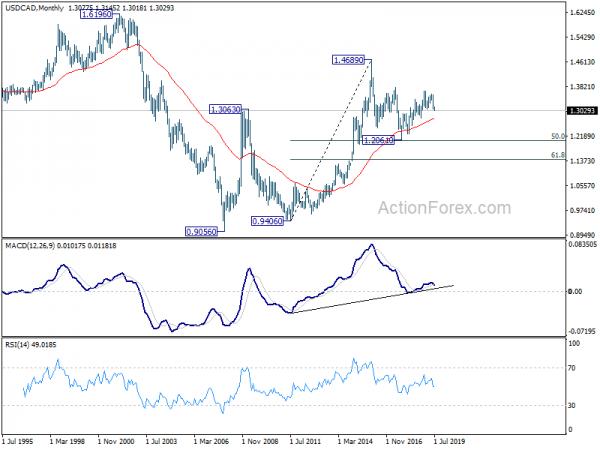

In the longer term picture, outlook remains unchanged that price actions from 1.4689 (2016 high) are forming a corrective pattern. Rejection by 1.3793 resistance would raise the chance of lengthier extension, with risk of dropping through 1.2061 low before completion.