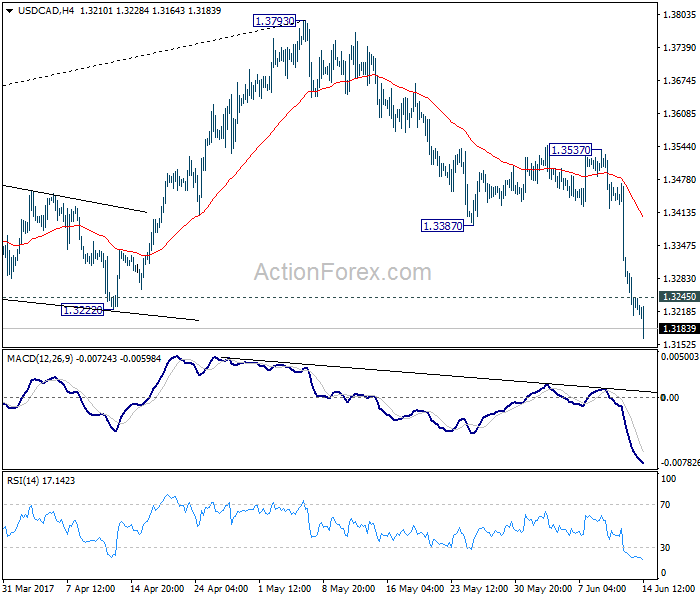

Daily Pivots: (S1) 1.3193; (P) 1.3259; (R1) 1.3306; More….

USD/CAD’s decline continues today and reaches as low as 1.3164 so far. The strong break of 1.3222 support as well ass the medium term channel support affirms our bearish view. That is, corrective rise from 1.2460 has already completed at 1.3793. Intraday bias stays on the downside for next key level at 1.2968 (38.2% retracement of 1.2460 to 1.3793 at 1.2969). On the upside, above 1.3245 minor resistance will turn bias neutral and bring consolidations. But upside should be limited by 1.3387 support turned resistance and bring fall resumption.

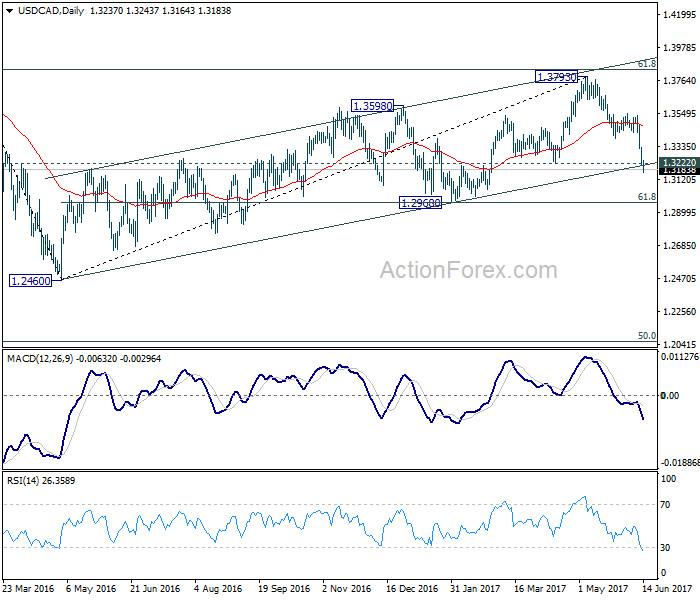

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. Rise from 1.2460 is seen as the second leg and has completed at 1.3793, ahead of 61.8% retracement of 1.4689 to 1.2460 at 1.3838. Break of 1.3222 should now indicate the start of the third leg while further break of 1.2968 should confirm. In that case, USD/CAD should decline through 1.2460 support to 50% retracement of 0.9406 to 1.4869 at 1.2048.