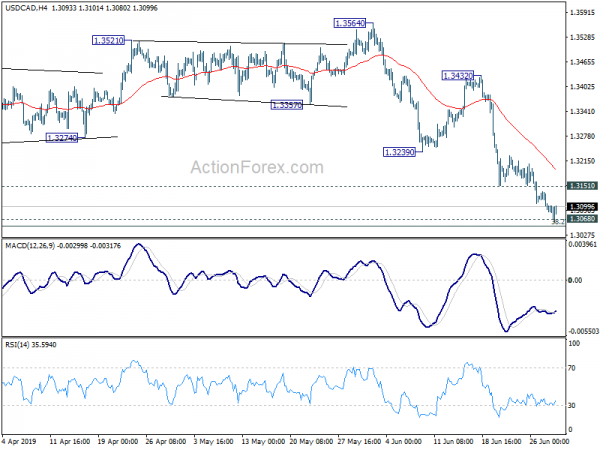

USD/CAD dropped further to as low as 1.3059 last week and is now pressing 1.3052/68 cluster support. Further decline is expected this week as long as 1.3151 minor resistance holds. Decisive break of 1.3052/68 will carry larger bearish implication and target 1.2673 fibonacci level next. However, break of 1.3151 will indicate short term bottoming and bring rebound back to 1.3239/3432 resistance zone.

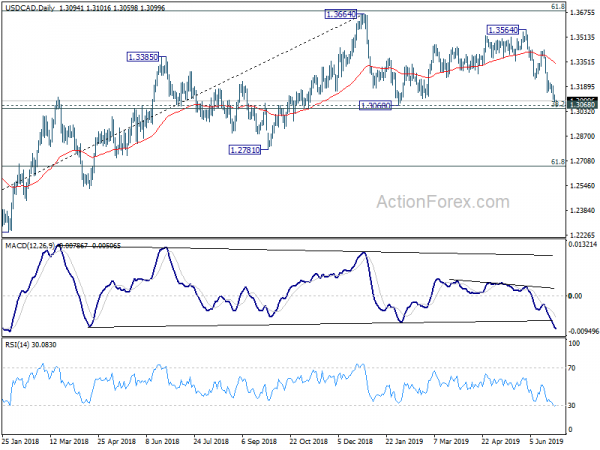

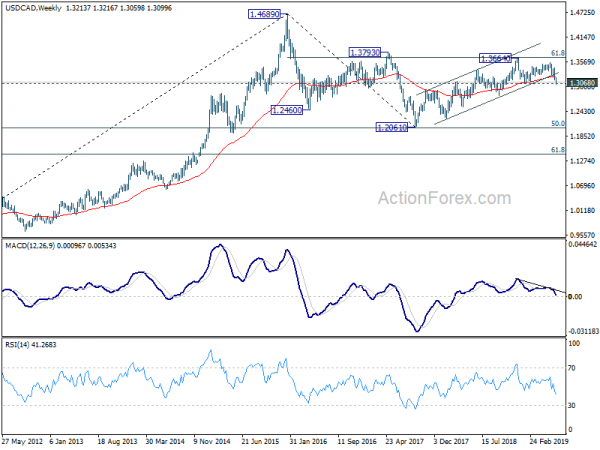

In the bigger picture, medium term outlook stays neutral for now even though the case of bearish reversal is building up. Decisive break of 1.3068 cluster support (38.2% retracement of 1.2061 to 1.3664 at 1.3052) will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next. On the upside, sustained break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685, is needed to confirm resumption of up trend from 1.2061 (2017 low). Otherwise, risk will stay on the downside.

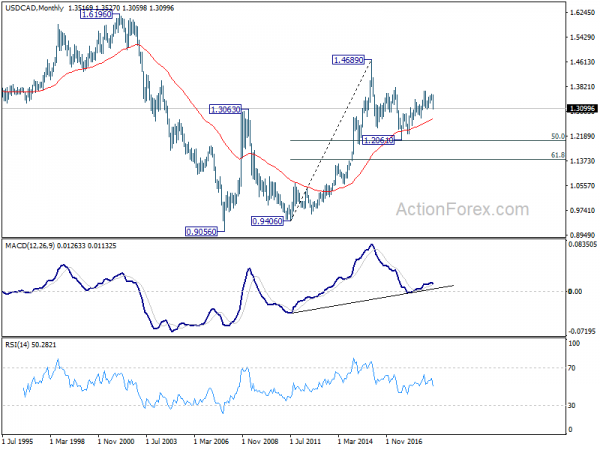

In the longer term picture, outlook remains unchanged that price actions from 1.4689 (2016 high) are forming a corrective pattern. Rejection by 1.3793 resistance would raise the chance of lengthier extension, with risk of dropping through 1.2061 low before completion.