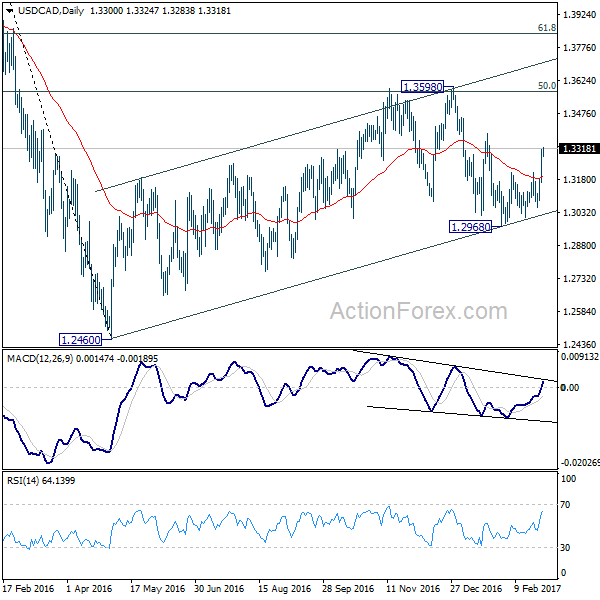

Daily Pivots: (S1) 1.3204; (P) 1.3259; (R1) 1.3354; More…

USD/CAD’s strong rally and break of 1.3211 resistance indicates resumption of rebound from 1.2968. Also, it should confirm completion of pull back from 1.3598. Intraday bias is now back on the upside for 1.3598 first. Break will extend the larger rally from 1.2460 towards next fibonacci level at 1.3838. On the downside, though, below 1.3164 minor support will turn bias back to the downside for 1.2968 support instead.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is likely still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. We’d look for reversal signal there to start the third leg. Break of 1.2968 wold at least bring at retest of 1.2460 low. However, sustained trading above 1.3838 would pave the way to retest 1.4689 high.