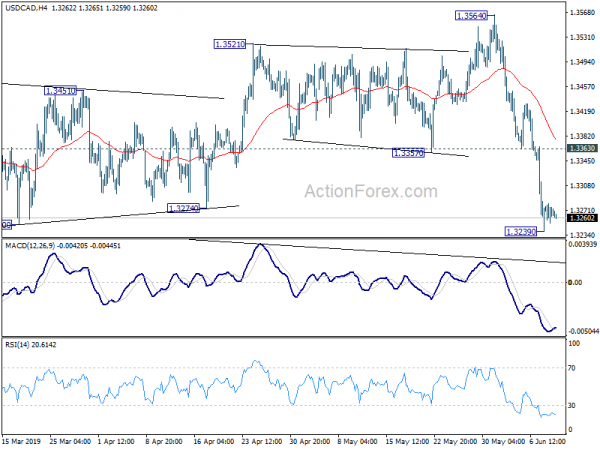

Daily Pivots: (S1) 1.3243; (P) 1.3266; (R1) 1.3291; More…

A temporary low is in place at 1.3239 in USD/CAD with 4 hour MACD crossed above signal line. Intraday bias is turned neutral for some consolidation first. Upside of recovery should be limited by 1.3363 support turned resistance to bring fall resumption. As noted before, choppy rise from 1.3068 has completed at 1.3564 already. Break of 1.3239 will turn bias back to the downside for 1.3052/68 cluster support.

In the bigger picture, the strong break of medium term channel support now argues that up trend from 1.2061 (2017 low) has completed at 1.3664 (2018 high), just ahead of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685, and 1.3793 resistance. Decisive break of 1.3068 cluster support (38.2% retracement of 1.2061 to 1.3664 at 1.3052) will confirm and pave the way to 61.8% retracement at 1.2673 next. For now, risk will remain on the downside as long as 1.3564 resistance holds, even in case of strong rebound.