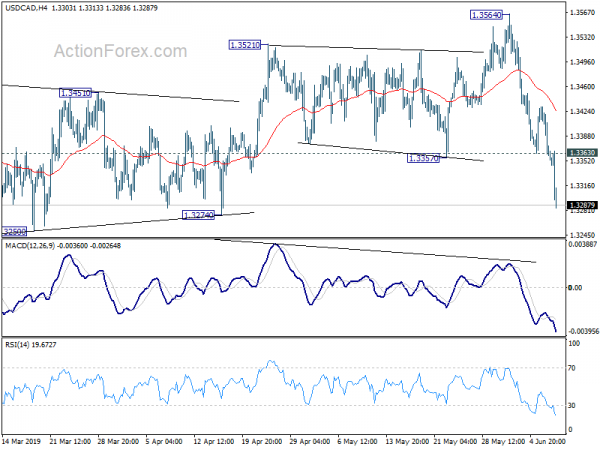

Daily Pivots: (S1) 1.3337; (P) 1.3385; (R1) 1.3410; More…

USD/CAD’s decline from 1.3564 resumes and accelerates to as low as 1.3286 so far. Intraday bias is back on the downside for 1.3274 support. Choppy corrective rise from 1.3068 should be completed at 1.3564 already. Break of 1.3274 will target 1.3068 key support level next. On the upside, break of 1.3363 support turned resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, the strong break of medium term channel support now argues that up trend from 1.2061 (2017 low) has completed at 1.3664, just ahead of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. Decisive break of 1.3068 cluster support (38.2% retracement of 1.2061 to 1.3664 at 1.3052) will confirm and pave the way to 61.8% retracement at 1.2673 next. For now, risk will remain on the downside as long as 1.3564 resistance holds, even in case of strong rebound.