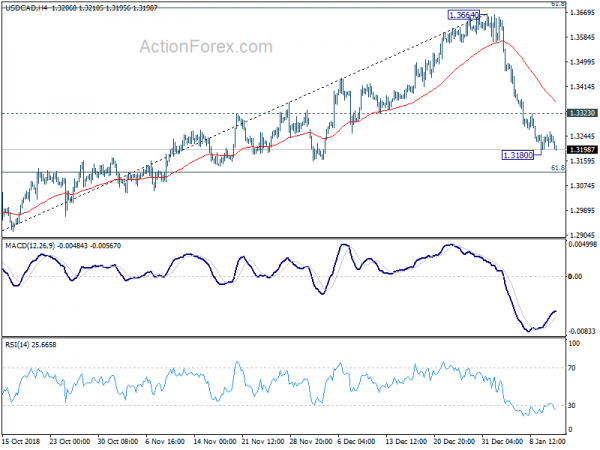

Daily Pivots: (S1) 1.3207; (P) 1.3233; (R1) 1.3265; More…

Intraday bias in USD/CAD is turned neutral as the consolidation fro 1.3180 temporary low might extend. But recovery should be limited by 1.3323 minor resistance to bring another decline. On the downside, break of 1.3180 will resume the fall from 1.3664 and target 61.8% retracement of 1.2781 to 1.3664 at 1.3118. We’ll start look for bottoming sign below there. On the upside, above 1.3323 will suggest short term bottoming and turn bias back to the upside for stronger rebound.

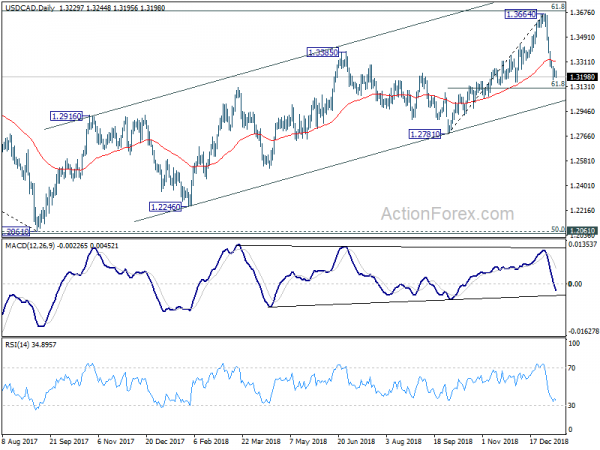

In the bigger picture, the medium term rise from 1.2061 (2017 low) might continue further. But the structure of such rise is not clearly impulsive so far. Hence, we’d stay cautious on strong resistance from 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 and 1.3793 resistance to limit upside, and bring medium term topping. But in any case, medium term outlook will stay bullish as long as channel support (now at 1.2993) holds. Sustained break of 1.3793 will pave the way to retest 1.4689 (2015 high).