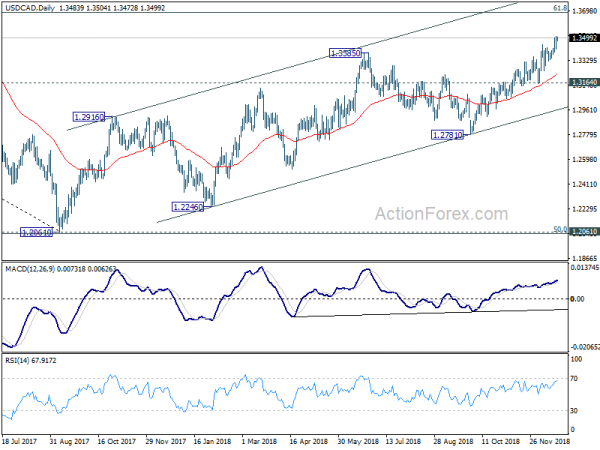

Daily Pivots: (S1) 1.3426; (P) 1.3466; (R1) 1.3518; More…

Intraday bias in USD/CAD remains on the upside at this point. Rise from 1.2781 is part of the up trend from 1.2061 and would target 1.3685 fibonacci level next. On the downside, below 1.3415 minor support will turn intraday bias neutral first and bring consolidations. But retreat should be contained well above 1.3164 support to bring rise resumption.

In the bigger picture, up trend from 1.2061 (2017 low) is still in progress and should target to 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. However, such rise is not clearly impulsive yet. And it could be the second leg of the long term corrective pattern that started at 1.4689. Hence, even in case of further rally, we’d be cautious on loss of momentum and topping above 1.3685. Nevertheless, in any case, outlook will stay bullish as long as channel support (now at 1.2972) holds.