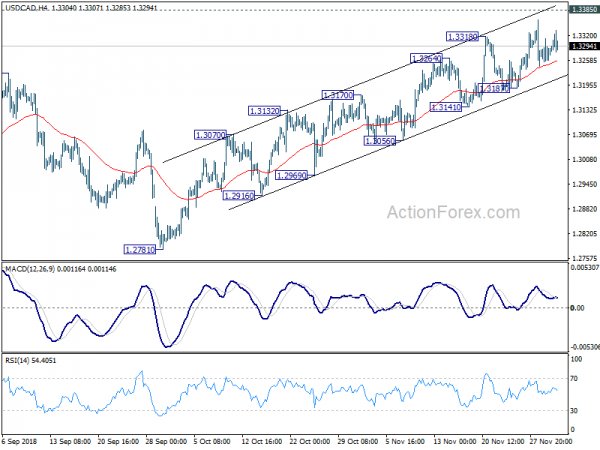

USD/CAD rise from 1.2781 extended again last week but upside momentum remained unconvincing. Hence, while further rally might be seen this week, we stay cautious on strong resistance from 1.3385 to limit upside and bring near term reversal. On the downside, break of 1.3187 support will argue that rise from 1.2781 has completed. And intraday bias would be turned back to the downside for 55 day EMA (now at 1.3134) and below. Nevertheless, strong break of 1.3385 will confirm medium term up trend resumption.

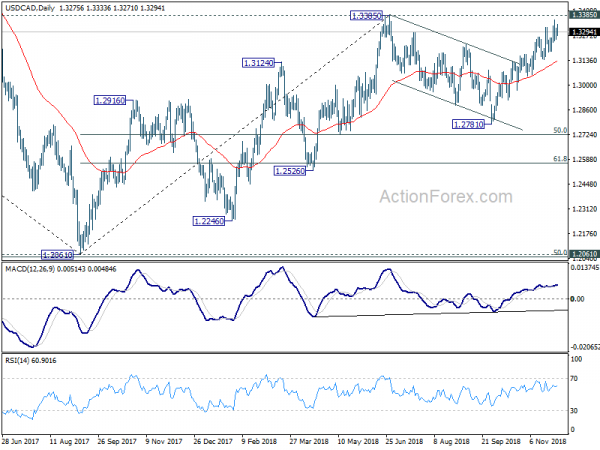

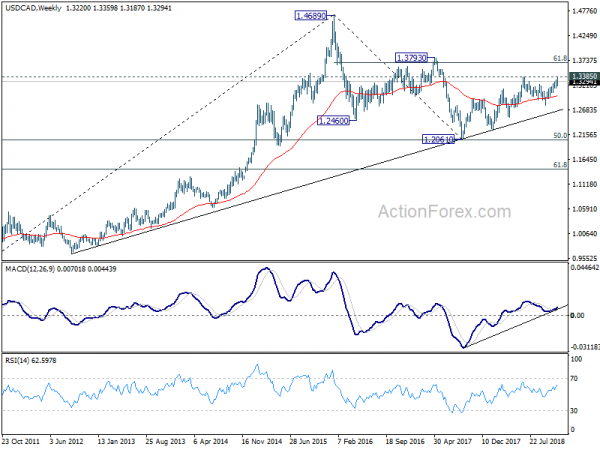

In the bigger picture, current development argues that corrective fall from 1.3385 has completed at 1.2781 already. And whole up trend from 1.2061 (2016 low) is ready to resume. Break of 1.3385 will target 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. This will now be the favored case as long as 1.2781 support holds.

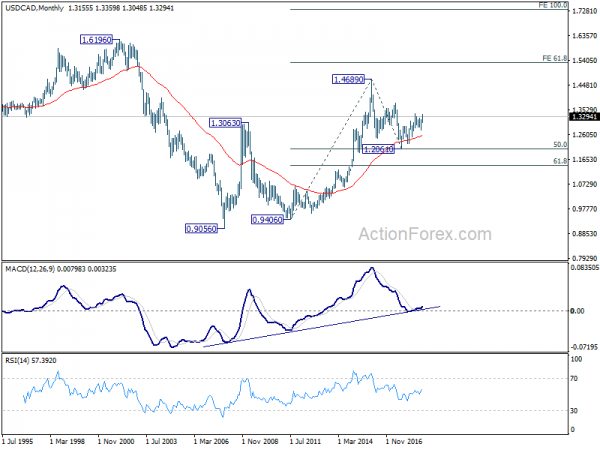

In the longer term picture, corrective fall from 1.4689 (2015 high) should have completed with three waves down to 1.2061, just ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. The development keeps long term up trend from 0.9406 and that from 0.9056 (2007 low) intact. For now, there is prospect of extending the long term up trend to 61.8% projection of 0.9406 to 1.4689 from 1.2061 at 1.5326 in medium to long term.