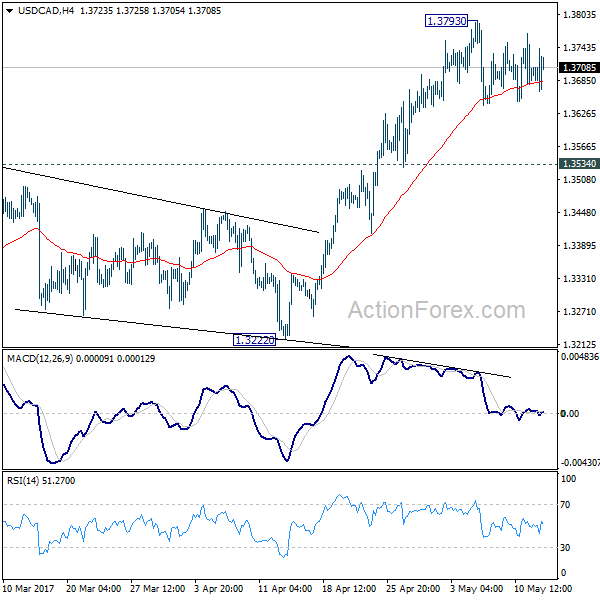

USD/CAD stayed in consolidation below 1.3793 last week and outlook is unchanged. Initial bias remains neutral this week. We’re seeing choppy rise from 1.2460 as a corrective move. Hence, in case of another rally, we’d expect upside to be limited by 1.3838 fibonacci level to bring reversal. Meanwhile, break of 1.3534 resistance turned support will suggest that rise from 1.2968 has completed. In such case, intraday bias will be turned back to the downside for medium term channel (now at 1.3176).

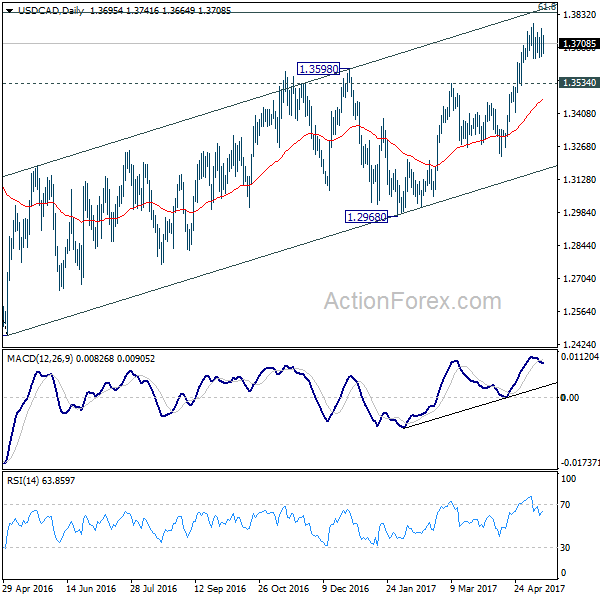

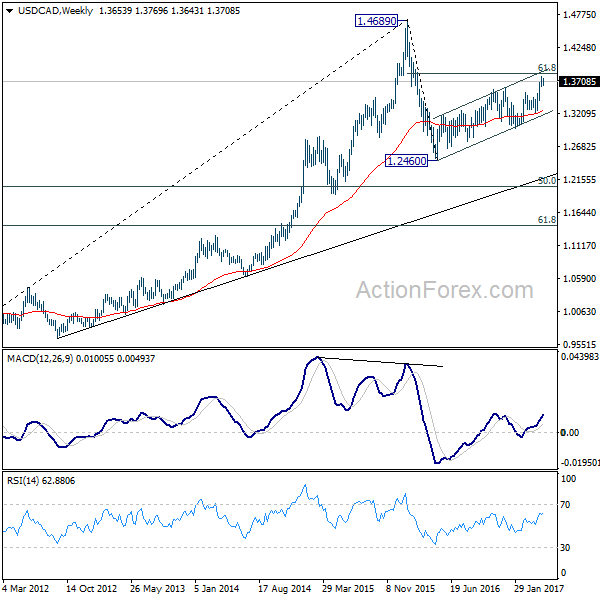

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. Rise from 1.2460 is seen as the second leg and would end at around 61.8% retracement of 1.4689 to 1.2460 at 1.3838. Break of 1.3222 should indicate the start of the third leg while further break of 1.2968 should confirm. Nonetheless, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

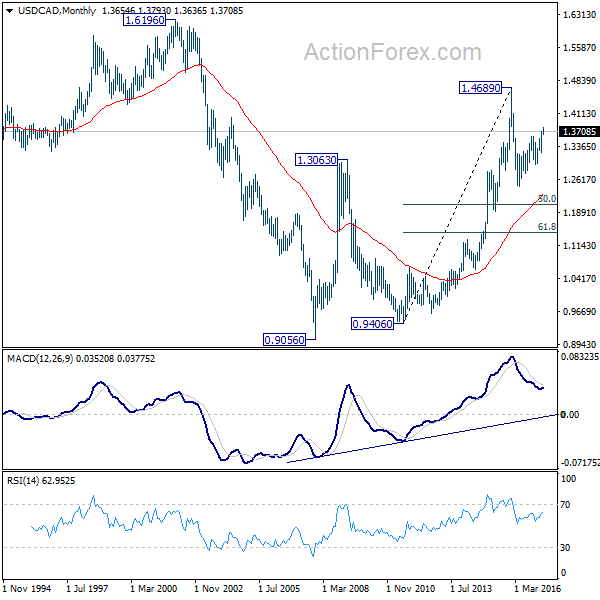

In the longer term picture, rise from 0.9056 (2007 low) is viewed as a long term up trend. It’s taking a breath after hitting 1.4689. But such rise expected to resume later to test 1.6196 down the road.