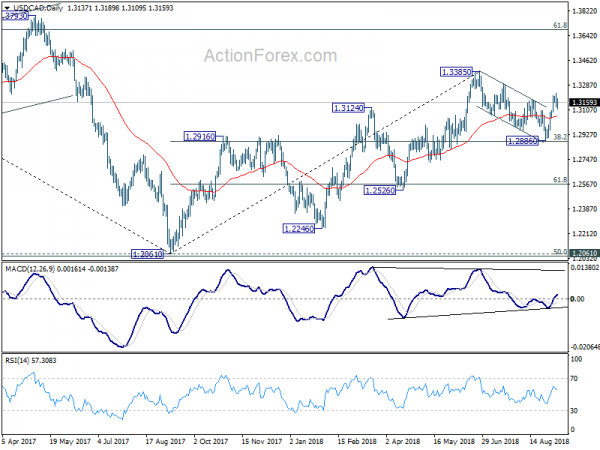

USD/CAD’s strong rebound last week argues that corrective fall from 1.3385 has completed at 1.2886 already. And, 1.2879 fibonacci level was defended. the development also revived the bullish case that rise from 1.2061 isn’t completed. With a temporary top formed at 1.3225, initial bias is neutral this week first. Downside of retreat should be contained well above 1.2886 to bring rally resumption. On the upside, above 1.3225 will target a test on 1.3385 high.

In the bigger picture, strong rebound ahead of 38.2% retracement of 1.2061 to 1.3385 at 1.2879 key fibonacci level retains medium term bullishness. That is, rise from 2017 low at 1.2061 is still in progress. Break of 1.3384 should target 61.8% retracement of 1.4689 (2015 high) to 1.2061 (2017 low) at 1.3685. On the downside, as long as 1.2886 support holds, outlook will now remain bullish.

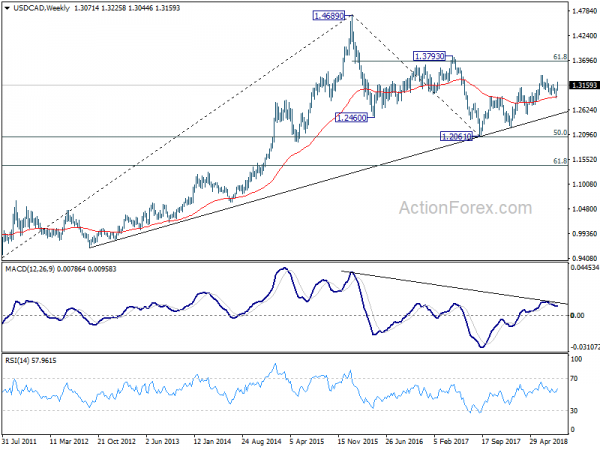

In the longer term picture, corrective fall from 1.4689 (2015 high) should have completed with three waves down to 1.2061, just ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. The development keeps long term up trend from 0.9406 and that from 0.9056 (2007 low) intact. For now, there is prospect of extending the long term up trend to 61.8% projection of 0.9406 to 1.4689 from 1.2061 at 1.5326 in medium to long term.