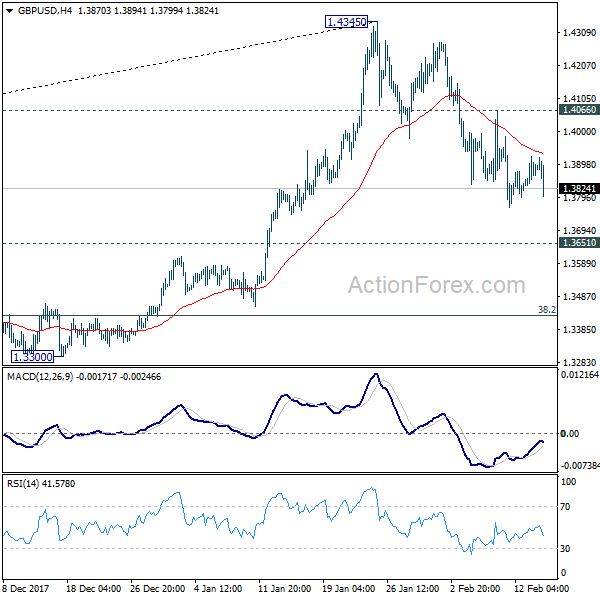

Daily Pivots: (S1) 1.3841; (P) 1.3882; (R1) 1.3932; More…..

GBP/USD failed to take out 4 hour 55 EMA and weakens again in early US session. Outlook in GBP/USD remains unchanged as fall from 1.4345 is expected to extend to 1.3651 resistance turned support. It’s still unsure whether decline from 1.4345 is correcting rise from 1.3038, or that from 1.1946, or it’s reversing the trend. Break of 1.3651 will turn focus to key fibonacci level at 1.3429. On the upside, break of 1.4066 will turn bias back to the upside for retesting 1.4345 instead.

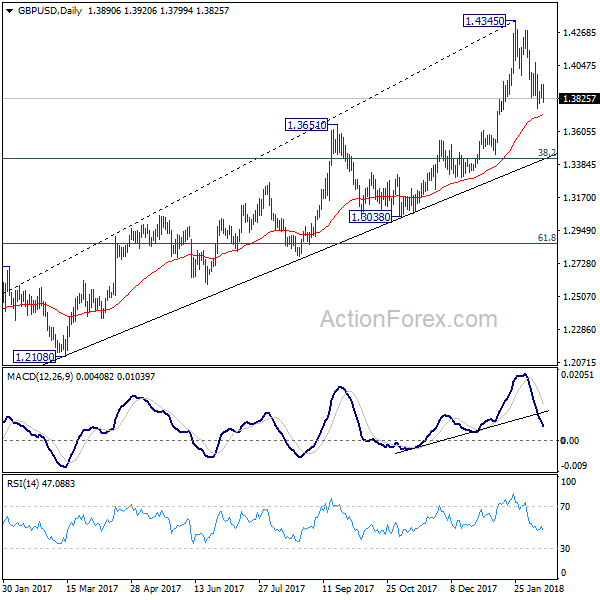

In the bigger picture, as long as 1.3038 support holds, medium term outlook in GBP/USD will remains bullish. Rise from 1.1946 is at least correcting the long term down from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4279 so far. Break of 1.3038 support, will suggests that rise from 1.1946 has completed and will turn outlook bearish for retesting this low.