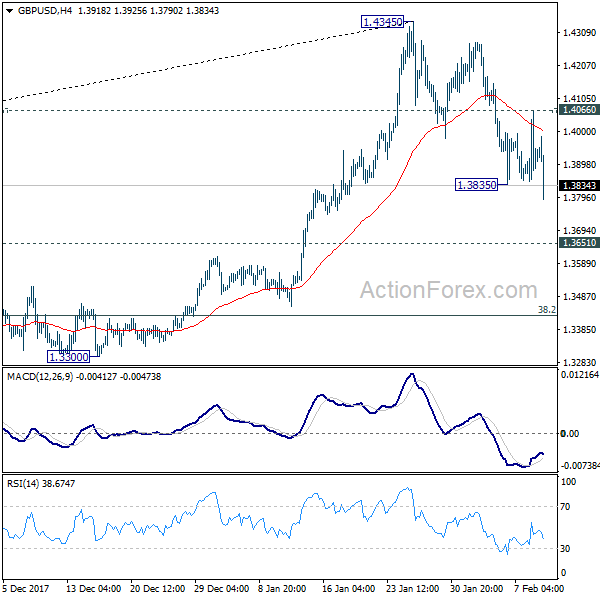

Daily Pivots: (S1) 1.3814; (P) 1.3940; (R1) 1.4035; More…..

GBP/USD’s recovery was limited by 4 hour 55 EMA. Subsequent break of 1.3835 indicates resumption of decline from 1.4345 and intraday bias is turned to the downside for 1.3651 resistance turned support. At this point, it’s still unsure whether decline from 1.4345 is correcting rise from 1.3038, or that from 1.1946, or it’s reversing the trend. Break of 1.3651 will turn focus to key fibonacci level at 1.3429. For the moment, further decline will remain expected as long as 1.4066 minor resistance holds.

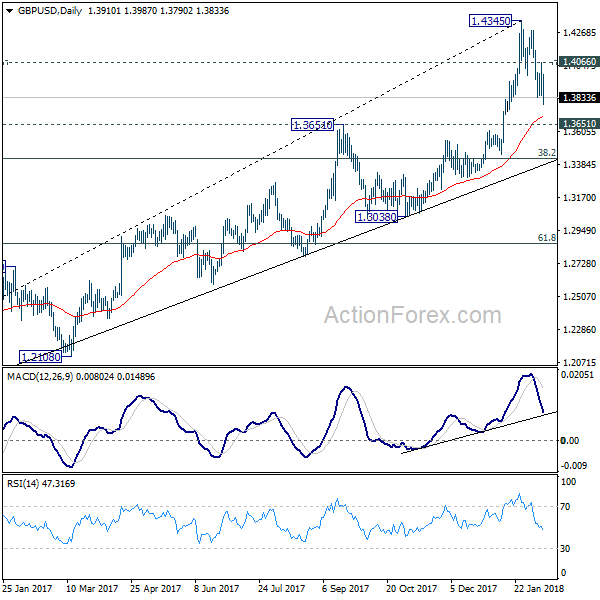

In the bigger picture, sustained break of 1.3835 key resistance level indicates that rebound from 1.1946 is at least correcting the long term down from from 2007 high at 2.1161. Further rise should now be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. Medium term outlook will stay bullish 38.2% retracement of 1.1946 to 1.4345 at 1.3429, in case of deep pull back.