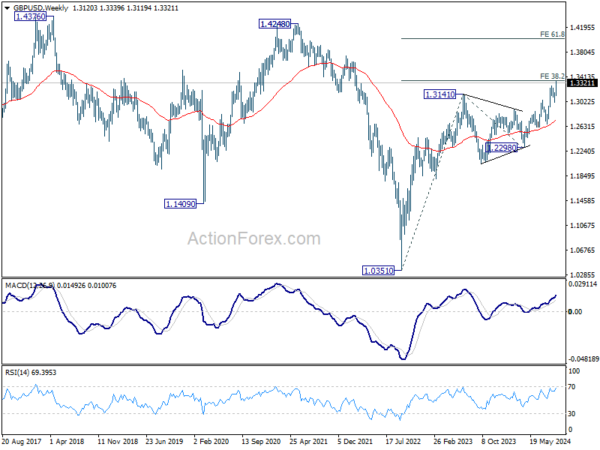

GBP/USD’s up trend resumed last week by breaking through 1.3265. Initial bias stays on the upside this week for 61.8% projection of 1.2664 to 1.3265 from 1.3000 at 1.3371. Firm break there will pave the way to 100% projection at 1.3601 next. On the downside, below 1.3219 minor support will turn intraday bias neutral and bring consolidations first. But outlook will stay bullish as long as 1.3000 support holds.

In the bigger picture, up trend from 1.0351 (2022 low) is in progress. Next target is 38.2% projection of 1.0351 to 1.3141 from 1.2298 at 1.3364. Decisive break there will target 61.8% projection at 1.4022. For now, outlook will stay bullish as long as 1.2892 resistance turned support holds, even in case of deep pullback.

In the long term picture, as long as 1.2298 support holds, rise from 1.0351 long term bottom is expected to continue. The strong break of 55 M EMA (now at 1.2811) is a sign of bullish trend reversal. Yet, break of 1.4248 structural resistance is needed confirm. Otherwise, price actions from 1.0351 could just be part of a consolidation pattern.