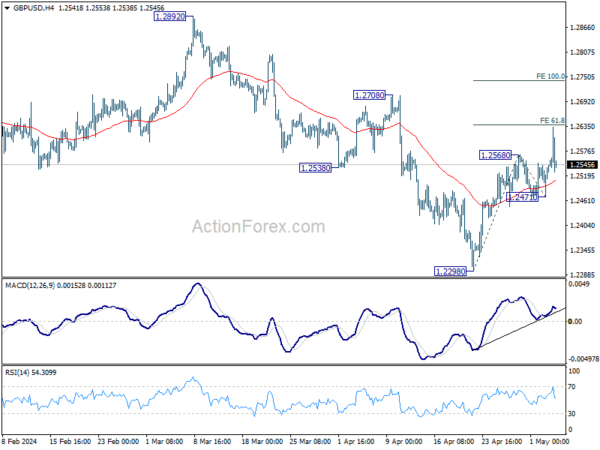

GBP/USD’s rebound from 1.2298 resumed by breaking through 1.2568 last week. The strong break of 55 D EMA suggest that fall from 1.2892 has completed with three waves down to 1.2298. Initial bias stays on the upside this week. Break of 61.8% projection of 1.2298 to 1.2568 from 1.2471 will target 100% projection at 1.2741. For now, further rally will be expected as long as 1.2471 support holds, in case of retreat.

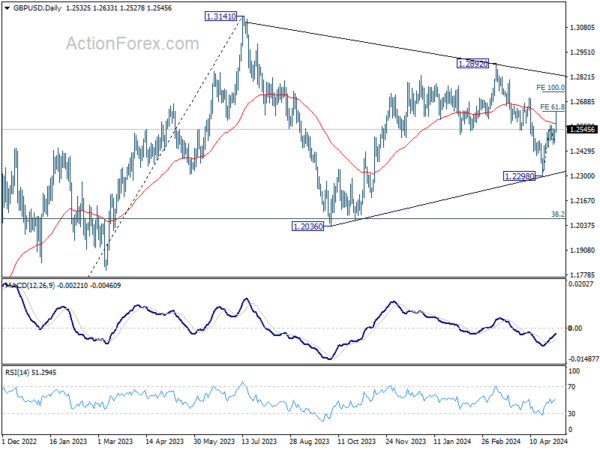

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern. Fall from 1.2892 is seen as the third leg which might have completed already. Break of 1.2892 resistance will argue that larger up trend from 1.0351(2022 low) is ready to resume through 1.3141. Meanwhile, break of 1.2298 support will extend the corrective pattern instead.

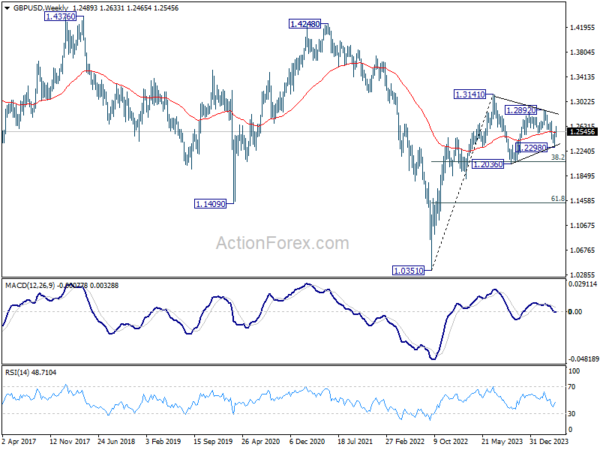

In the long term picture, a long term bottom should be in place at 1.0351 on bullish convergence condition in M MACD. But momentum of the rebound from 1.3051 argues GBP/USD is merely in consolidation, rather than trend reversal. Range trading is likely between 1.0351/4248 for some more time.