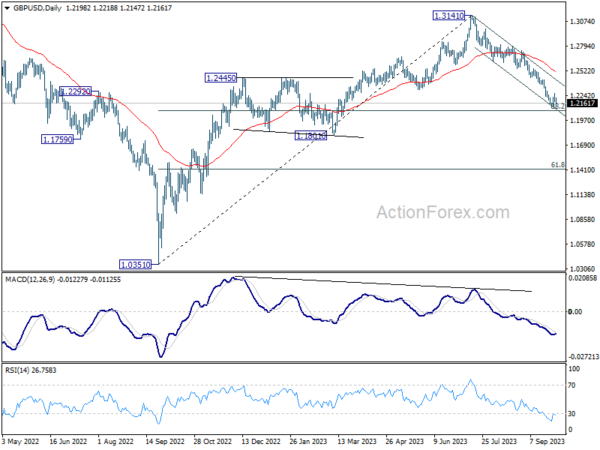

Daily Pivots: (S1) 1.2167; (P) 1.2219; (R1) 1.2258; More…

GBP/USD dips notably after rejection by 55 4H EMA, but stays above 1.2109 support. Intraday bias remains neutral for the moment. While stronger recovery cannot be ruled out, near term outlook will stay bearish as long as 1.2420 resistance holds. On the downside, decisive break of 1.2075 fibonacci level would carry larger bearish implication and target 1.1801 support next.

In the bigger picture, fall from 1.3141 medium term top could still be a correction to up trend from 1.0351 (2022 low) only. But risk of complete trend reversal is rising. Sustained break of 38.2% retracement of 1.0351 to 1.3141 at 1.2075 will pave the way to 61.8% retracement at 1.1417. For now, risk will stay on the downside as long as 55 D EMA (now at 1.2517) holds, in case of rebound.