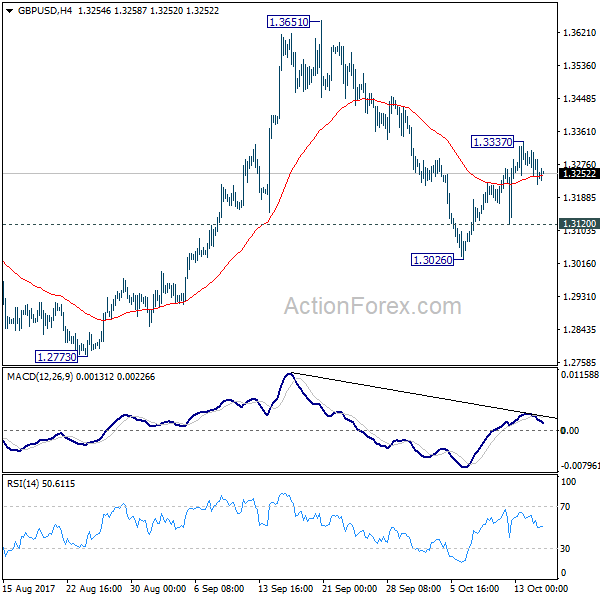

Daily Pivots: (S1) 1.3212; (P) 1.3261; (R1) 1.3299; More….

A temporary top is in place at 1.3337 in GBP/USD and intraday bias is turned neutral first. Another rise is mildly in favor as long as 1.3120 minor support holds. Above 1.3337 will target a test on 1.3651 high. Break there will resume medium term rise from 1.1946 and target 1.3835 key resistance next. On the downside, below 1.3120 minor support will resume the fall from 1.3651 through 1.3026 instead.

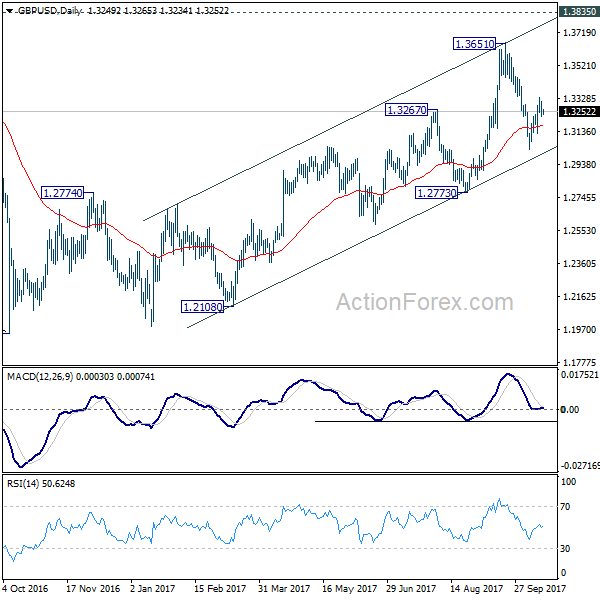

In the bigger picture, while the medium term rebound from 1.1946 was strong, GBP/USD hit strong resistance from the long term falling trend line. Outlook is turned a bit mixed and we’ll turn neutral first. On the downside, decisive break of 1.2773 key support will argue that rebound from 1.1946 has completed. The corrective structure of rise from 1.1946 to 1.3651 will in turn suggest that long term down trend is now completed. Break of 1.1946 low should then be seen. On the upside, break of 1.3835 support turned resistance will revive the case of trend reversal and target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466.