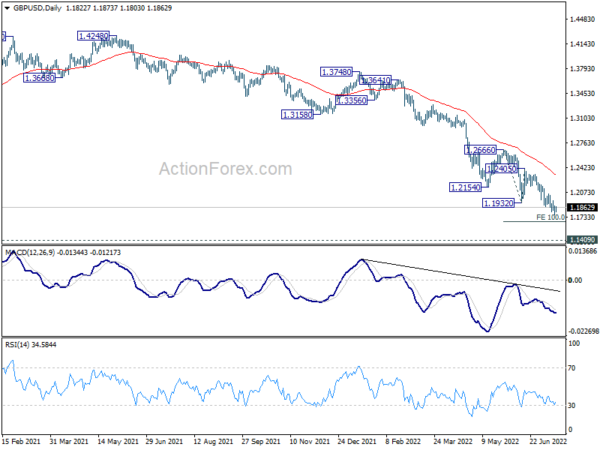

GBP/USD edged lower to 1.1759 last week but recovered again. Initial bias is neutral this week first and further fall is expected with 1.2055 minor resistance intact. Below 1.1759 will resume recent down trend to 100% projection of 1.2666 to 1.1932 from 1.2405 at 1.1671. Break there will target 1.1409 long term support. Nevertheless, break of 1.2055 will turn bias to the upside for stronger rebound.

In the bigger picture, fall from 1.4248 (2018 high) could be a leg inside the pattern from 1.1409 (2020 low), or resuming the longer term down trend. Deeper decline is expected as long as 1.2666 resistance holds. Next target is 1.1409 low. However, firm break of 1.2666 will bring stronger rise back to 55 week EMA (now at 1.3065).

In the longer term picture, rebound from 1.1409 long term bottom should have completed at 1.4248 already, well ahead of 38.2% retracement of 2.1161 to 1.1409 at 1.5134. The development argues that price actions from 1.1409 are developing into a corrective pattern only. That is, long term bearishness is retained for resuming the down trend from 2.1161 (2007 high) at a later stage.