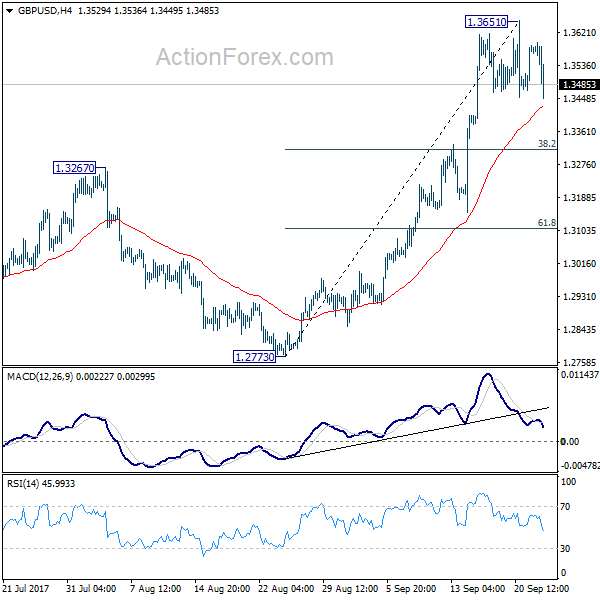

GBP/USD edged higher to 1.3651 last week but failed to extend gains. Initial bias is neutral this week for consolidation below 1.3651 first. In case of deeper fall, downside should be contained by 38.2% retracement of 1.2773 to 1.3651 at 1.3316 and bring rise resumption. Above 1.3651 will turn bias back to the upside for 1.3835 support turned resistance next. Break there will target 55 month EMA (now at 1.4405).

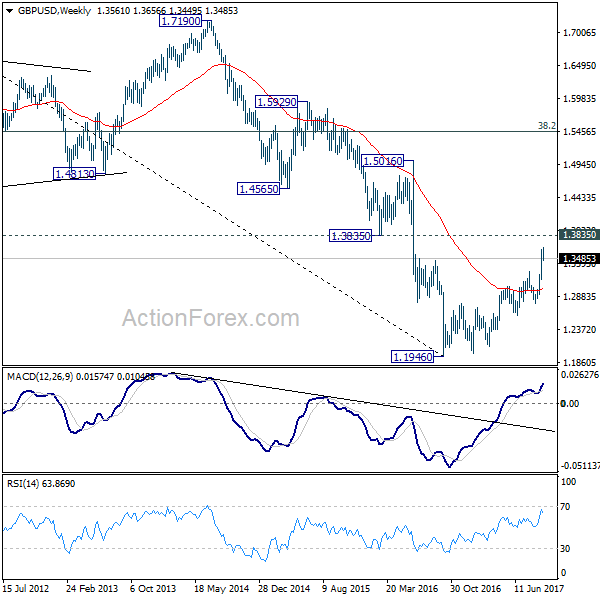

In the bigger picture, current development argues that the long term trend in GBP/USD has reversed. That is, a key bottom was formed back in 1.1946 on bullish convergence condition in monthly MACD. Current rise from 1.1946 will target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466 next. In any case, medium term outlook will now stay bullish as long as 1.2773 support holds.

In the longer term picture, current development argues that whole down trend form 2.1161 (2007 high) is completed at 1.1946 already (2016 low). It’s too early to tell is GBP/USD is staying a long term up trend. But in any case, further rise is in favor to 38.2% retracement of 2.1161 to 1.1946 at 1.5466 next. We’ll monitor the structure of the current rally from 1.1946 to decide if it’s an impulsive move.