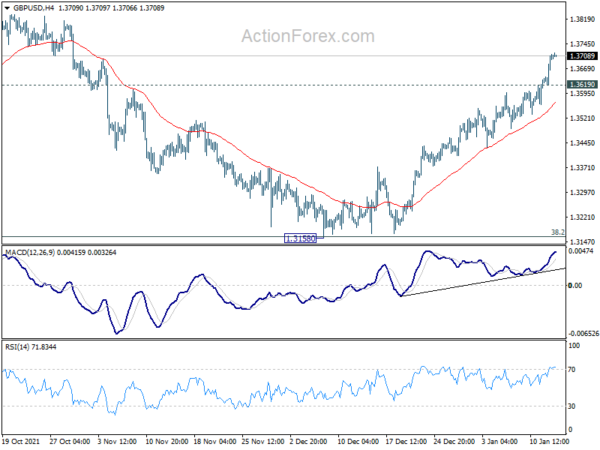

Daily Pivots: (S1) 1.3646; (P) 1.3680; (R1) 1.3737; More…

Intraday bias in GBP/USD remains on the upside as rise from 1.3158 is extending. No change in the view that corrective fall from 1.4282 should have completed with three waves down to 1.3158, after hitting 1.3164 medium term fibonacci level. Further rally should be seen to 1.3833 resistance first. Firm break there will pave the way to retest 1.4248 high. On the downside, below 1.3619 minor support will turn intraday bias neutral first. But further rise will remain in favor as long as 55 day EMA (now at 1.3479) holds.

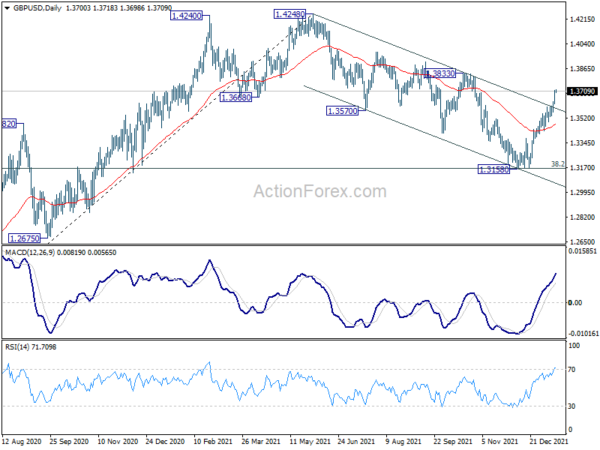

In the bigger picture, strong support was seen from 38.2% retracement of 1.1409 to 1.4248 at 1.3164. The development suggests that up trend from 1.1409 (2020 low) is still in progress. On resumption, next target will be 38.2% retracement of 2.1161 to 1.1409 at 1.5134. Nevertheless sustained break of 1.3164 will argue that whole rise from 1.1409 has completed and bring deeper fall to 61.8% retracement at 1.2493.