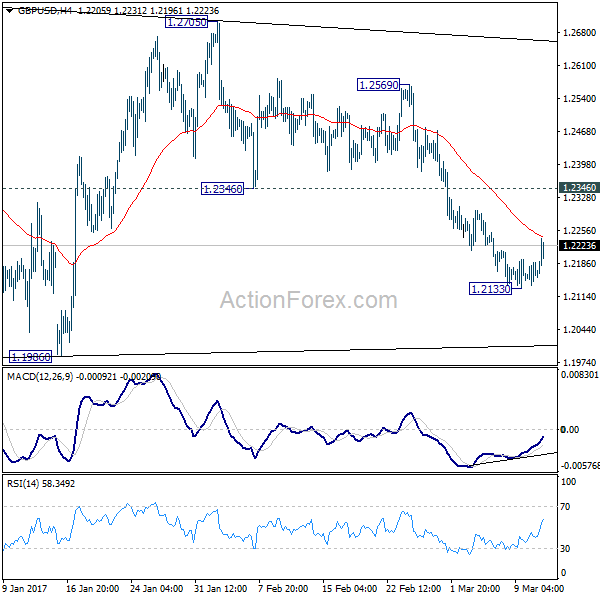

Daily Pivots: (S1) 1.2133; (P) 1.2160; (R1) 1.2187; More…

GBP/USD reaches as high as 1.2398 today so far as recovery from 1.2133 extends. Intraday bias remains neutral for the moment as such rise is seen as a correction. We’d expect upside of recovery to be limited by 1.2346 support turned resistance and bring fall resumption. As noted before, consolidation pattern from 1.1946 is completed at 1.2705 is resuming larger down trend. On the downside, below 1.2133 will turn bias to the downside for retesting 1.1946/86 support zone. Break of 1.1946 will confirm our bearish view. However, sustained break of 1.2346 will dampen out view and turn focus back to 1.2569 resistance first.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.