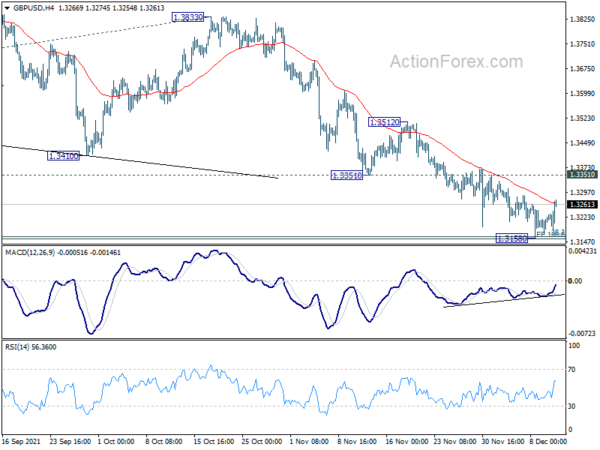

GBP/USD edged lower to 1.3158 last week, but quickly recovered again. Initial bias remains neutral this week first. Focus stays on 1.3164 medium term fibonacci level. Sustained break there will carry larger bearish implication, and target 161.8% projection of 1.4248 to 1.3570 from 1.3833 at 1.2736. On the upside, though, break of 1.3351 support turned resistance will indicate short term bottoming, and turn bias back to the upside for 1.3512 resistance next.

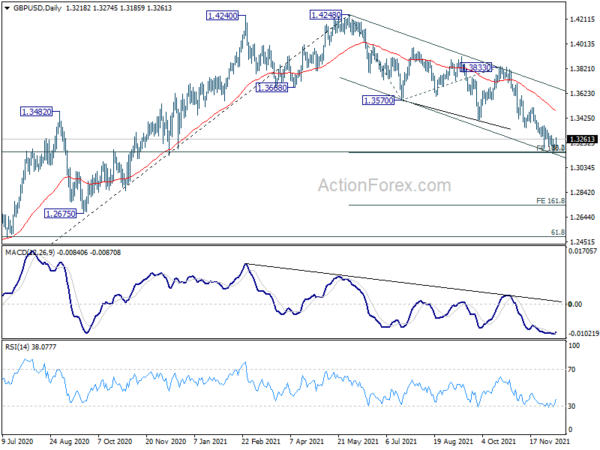

In the bigger picture, immediate focus is now on 38.2% retracement of 1.1409 to 1.4248 at 1.3164. Sustained break there will argue that whole rise from 1.1409 has completed at 1.4248, after rejection by 1.4376 long term resistance. That will revive some medium term bearishness and and target 61.8% retracement at 1.2493. However, strong rebound from current level will revive that case and up trend from 1.1409 is still in progress, and probably ready to resume.

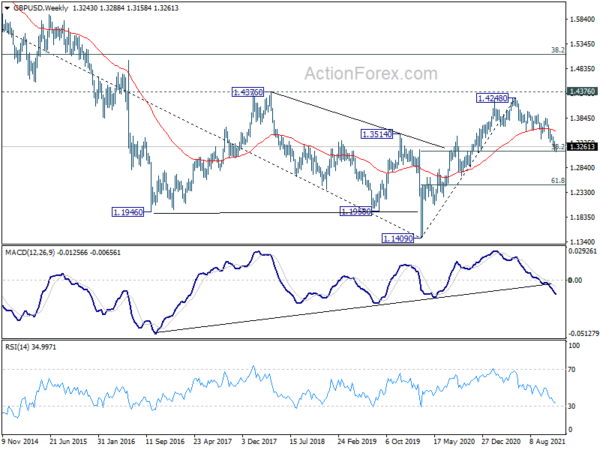

In the longer term picture, a long term bottom should be in place at 1.1409, on bullish convergence condition in monthly MACD. Rise from there would target 38.2% retracement of 2.1161 to 1.1409 at 1.5134. Reaction from there would reveal whether rise from 1.1409 is just a correction, or developing into a long term up trend.