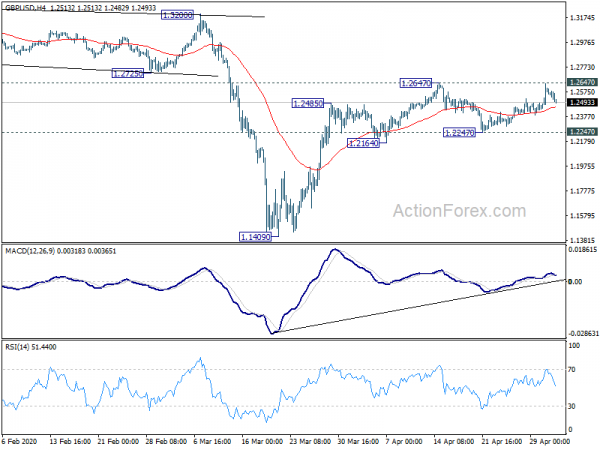

GBP/USD rebounded strongly last week but failed to break 1.2647 resistance. Initial bias remains neutral this week first. Further rise is in favor as long as 1.2247 support holds. Break of 1.2647 will resume the rise from 1.1409 to 1.3200 resistance. On the downside, break of 1.2247 support will indicate completion of rebound from 1.1409. Intraday bias will be turned back to the downside for retesting 1.1409 low.

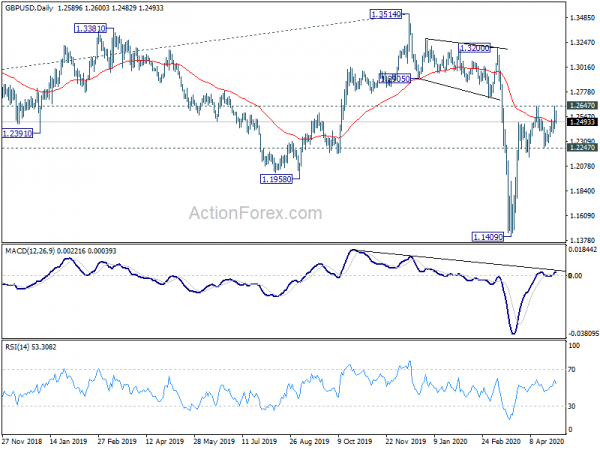

In the bigger picture, while the rebound from 1.1409 is strong, there is no indication of trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. Next medium term target will be 61.8% projection of 1.7190 to 1.1946 from 1.3514 at 1.0273. In any case, outlook will remain bearish as long as 1.3514 resistance holds, in case of strong rebound.

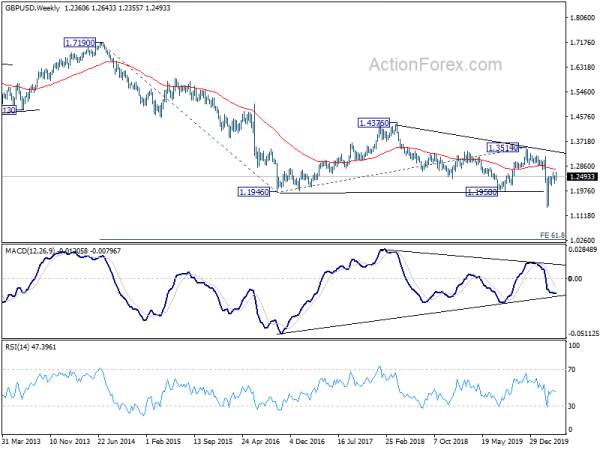

In the longer term picture, long term outlook remains clearly bearish, as it’s held well below long term falling trend line that started back at 2116 (2007 high). Rejection by 55 month EMA also affirmed bearishness. Break of 1.1946 will target 61.8% projection of 1.7190 to 1.1946 from 1.3514 at 1.0273.