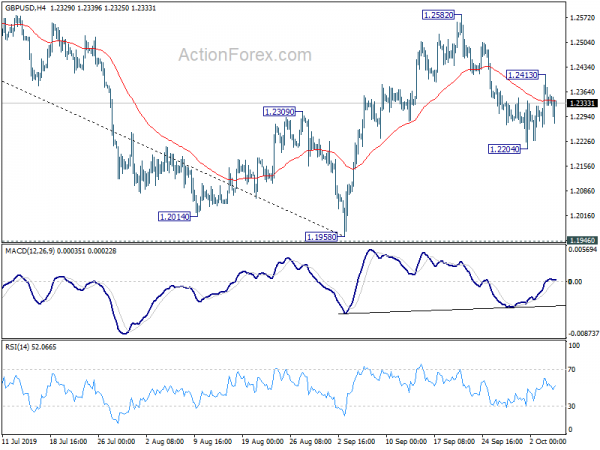

GBP/USD dropped to 1.2204 last week but quickly recovered. As there was no clear follow through buying, initial bias remains neutral this week first. On the downside, below 1.2204 will revive the case that rebound form 1.1958 has completed at 1.2582. Intraday bias will be turned back to the downside for retesting 1.1958. On the upside, above 1.2413 will bring stronger rebound to 1.2582 resistance instead.

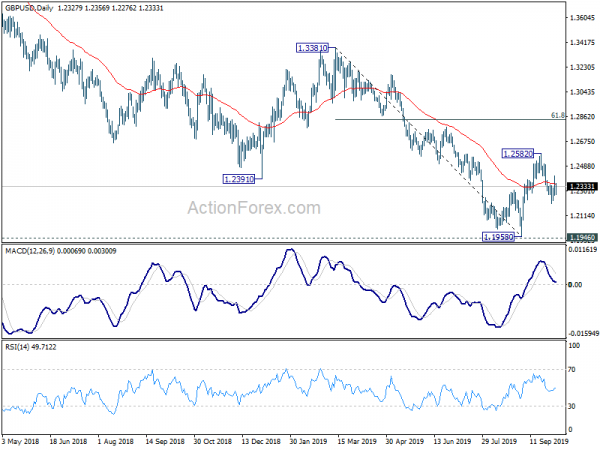

In the bigger picture, we’d remain cautious on medium term bottoming around 1.1946 (2016 low). Sustained trading above 55 week EMA (now at 1.2727) will extend the consolidation pattern from 1.1946 with another rise to 1.4376 resistance. Nevertheless, decisive break of 1.1946 will resume down trend from 2.1161 (2007 high) to 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135.

In the longer term picture, corrective rebound from 1.1946 (2016 low) was rejected by 55 month EMA. Long term outlook remains bearish. Firm break of 1.1946 will indicate resumption of down trend from 2.1161 (2007 high). Next target is 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135.