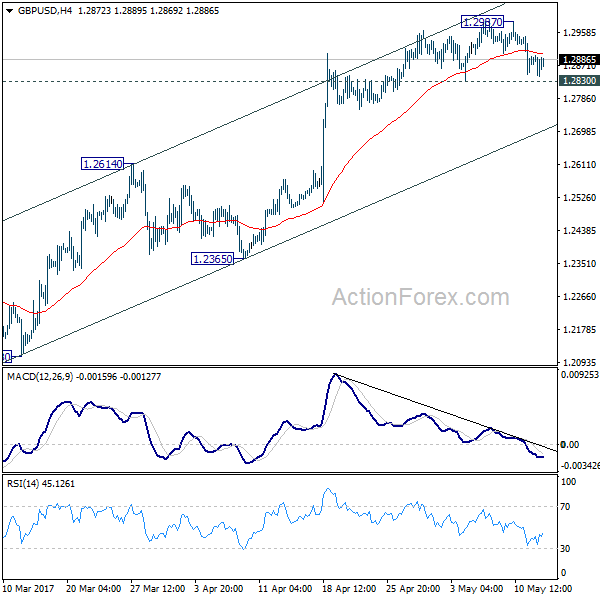

GBP/USD edged higher to 1.2987 last week but dipped sharply since then. Nonetheless, it’s staying above 1.2830 minor support. Hence, initial bias is neutral this week first. Considering bearish divergence condition in 4 hour MACD, break of 1.2830 will indicate short term topping. In such case, intraday bias is turned back to the downside for 1.2614 resistance turned support first. Overall, price actions from 1.1946 are viewed as a corrective pattern. There, in case of another rise, we’d start to look for reversal signal again above 1.2987.

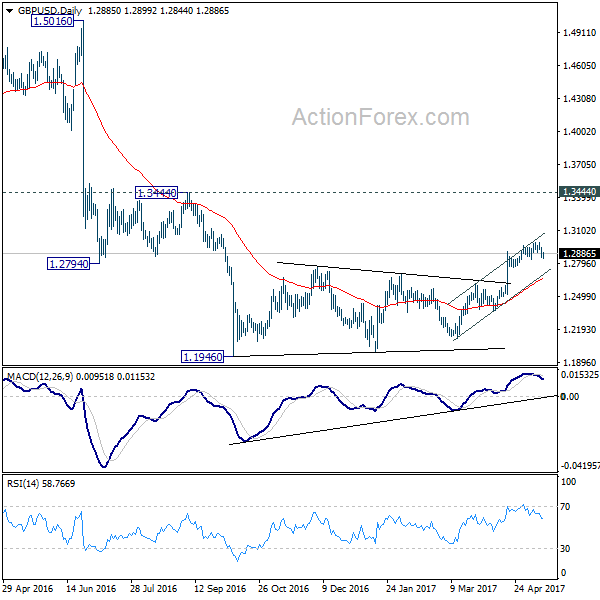

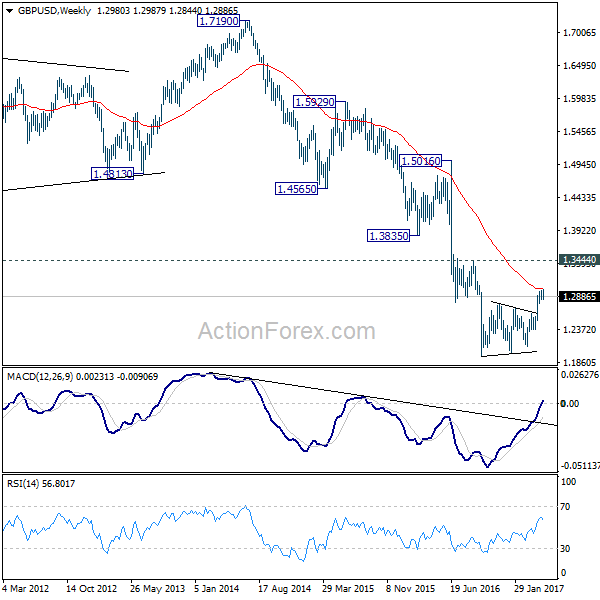

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term reversal yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

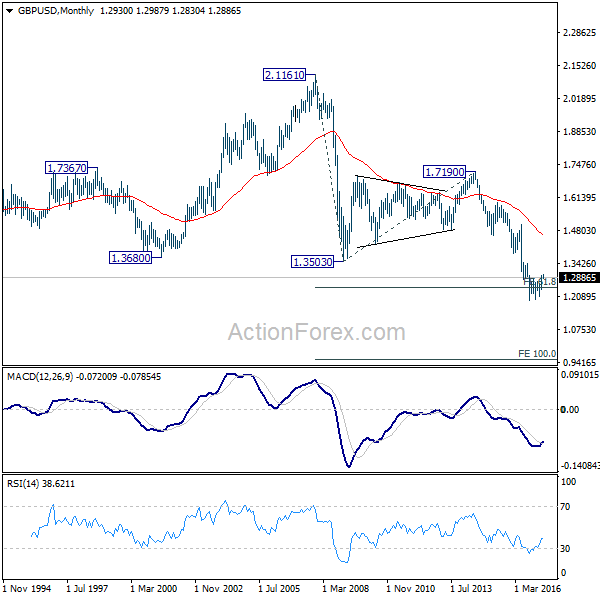

In the longer term picture, no change in the view that down trend from 2.1161 is still in progress. Current momentum suggests that the down trend will go deeper than originally expected to 100% projection of 2.1161 to 1.3503 from 1.7190 at 0.9532.