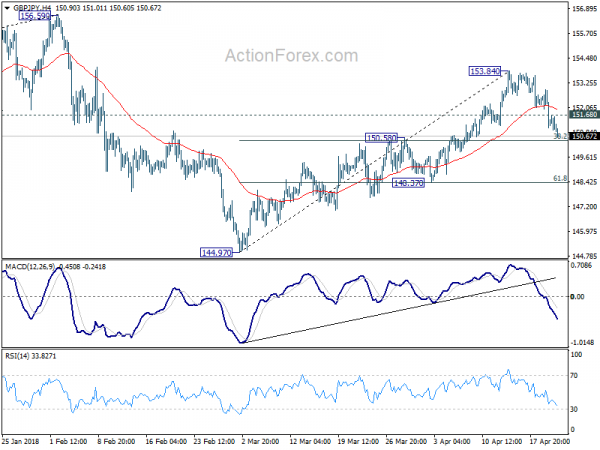

GBP/JPY’s sharp fall last week indicates that corrective rise from 144.97 has completed at 153.84 already. Decline from 153.84 should the third leg of the pattern fro 156.69. Initial bias remains on the downside this week for deeper fall to 148.30 support. Break till bring retest of 144.97 low. On the upside, above 151.68 minor resistance will turn intraday bias neutral first. But near term risk will now stay on the downside as long as 153.84 holds.

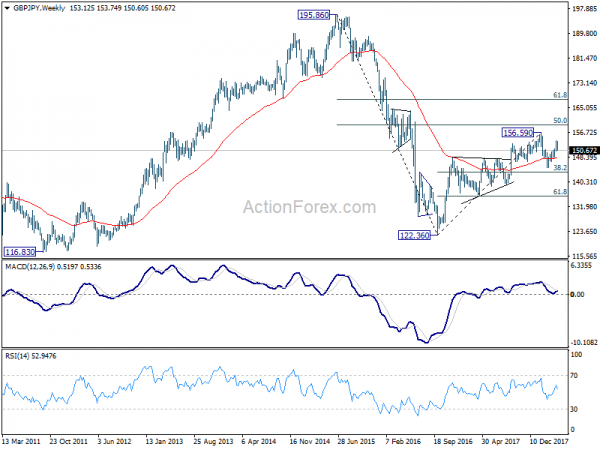

In the bigger picture, price actions from 156.59 are viewed as a corrective pattern. For now, we’d expect at least one more fall for 38.2% retracement of 122.36 to 156.59 at 143.51 before the consolidation completed. Though, firm break of 156.59 will resume whole up trend from 122.36 (2016 low) to 50% retracement of 195.86 (2015high) to 122.36 at 159.11 next.

In the bigger picture, price actions from 156.59 are viewed as a corrective pattern. For now, we’d expect at least one more fall for 38.2% retracement of 122.36 to 156.59 at 143.51 before the consolidation completed. Though, firm break of 156.59 will resume whole up trend from 122.36 (2016 low) to 50% retracement of 195.86 (2015high) to 122.36 at 159.11 next.

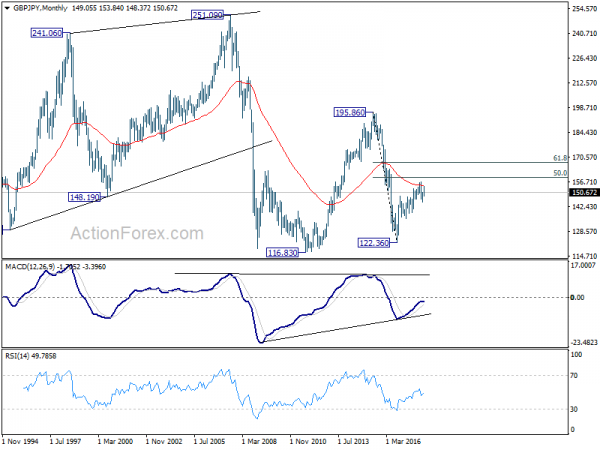

In the longer term picture, current development suggests that rise from 122.36 (2016 low) is not completed yet. Such rally could extend to 61.8% retracement of 195.86 (2015high) to 122.36 at 167.78 before completion. This will now be the preferred case as long as 139.29 support holds.

In the longer term picture, current development suggests that rise from 122.36 (2016 low) is not completed yet. Such rally could extend to 61.8% retracement of 195.86 (2015high) to 122.36 at 167.78 before completion. This will now be the preferred case as long as 139.29 support holds.