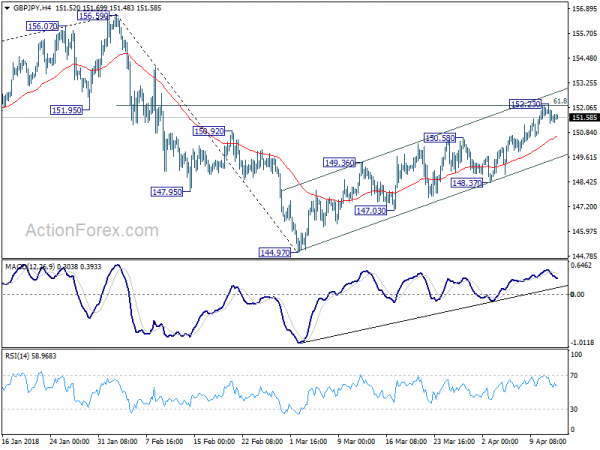

Daily Pivots: (S1) 151.06; (P) 151.59; (R1) 152.49; More…

GBP/JPY lost upside momentum after meeting 61.8% retracement of 156.59 to 144.97 at 152.15. A temporary top is in place at 152.23 and intraday bias is turned neutral. Another rise is in favor as long as 148.37 minor support holds. But again, price actions from 144.97 are still seen as corrective looking. Hence, we’ll look for sign of loss of upside momentum as it approaches 156.59 high. Meanwhile, break of 148.37 will indicate completion of the rebound from 144.97 and bring retest of this low.

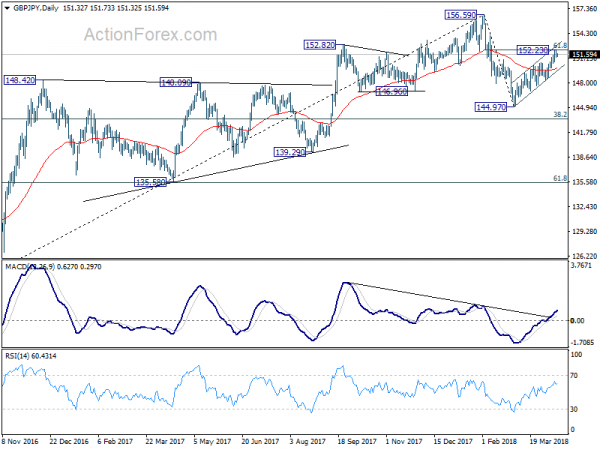

In the bigger picture, the outlook is turning mixed again. On the one hand, the cross was rejected by 55 month EMA (now at 154.20) after breaching it briefing. On the other hand, there was no sustainable selling pushing it through 38.2% retracement of 122.36 to 156.59 at 143.51. The most likely scenario is that GBP/JPY is turning into a sideway pattern between 143.51 and 156.59. And more range trading would now be seen before a breakout, possibly on the upside.