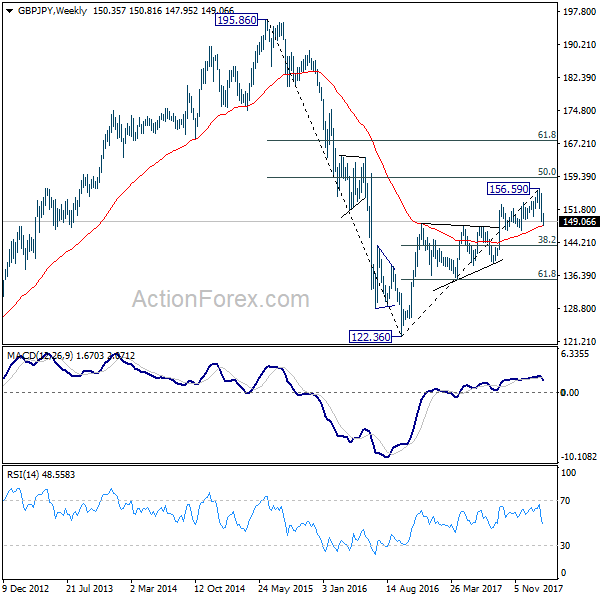

GBP/JPY’s fall from 156.59 extended to 147.95 last week but formed a temporary low there and recovered. Initial bias is neutral this week first. Upside of recovery should be limited by 151.19 resistance to bring another fall. Below 147.95 will target 146.96 support next. Considering bearish divergence condition in daily MACD, firm break of 146.96 will be another sign of medium term trend reversal. On the upside, break of 151.19 will indicate short term bottoming and turn bias back to the upside for rebound.

In the bigger picture, the case for medium term reversal continues to build up on loss of medium term momentum as seen in 4 hour MACD. Also, firm break of 146.96 will indicate rejection by 55 month EMA and add to that case of reversal. In that case, deeper fall would be seen to 38.2% retracement of 122.36 to 156.59 at 143.51 and then 61.8% retracement at 135.43. Meanwhile, break of 156.59 will extend the rise from 122.36 to 61.8% retracement of 195.86 to 122.36 at 167.78.

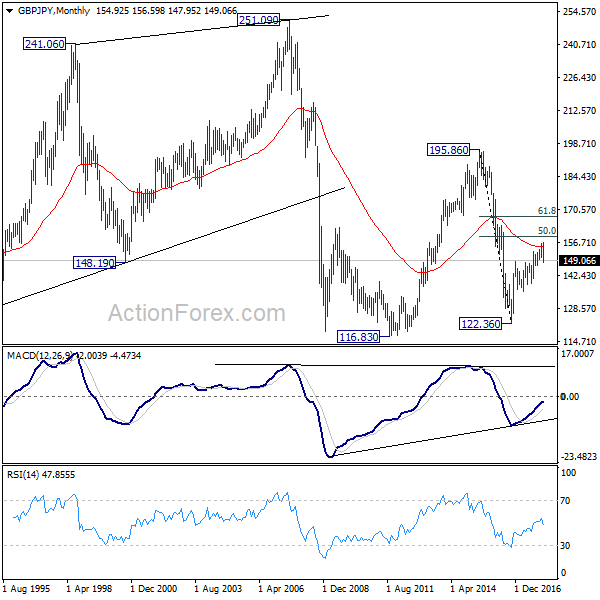

In the longer term picture, down trend from 195.86 (2015 high) has already completed at 122.36. Focus is now on 55 month EMA (now at 154.60). Firm break there will suggest that rise from 122.36 is developing into a long term move that target 195.86 again. And, price actions from 116.83 (2011 low) is indeed a sideway pattern that could last more than a decade. However, rejection from the 55 month EMA will turn focus back to 122.36 low.