Daily Pivots: (S1) 147.35; (P) 148.31; (R1) 149.65; More…

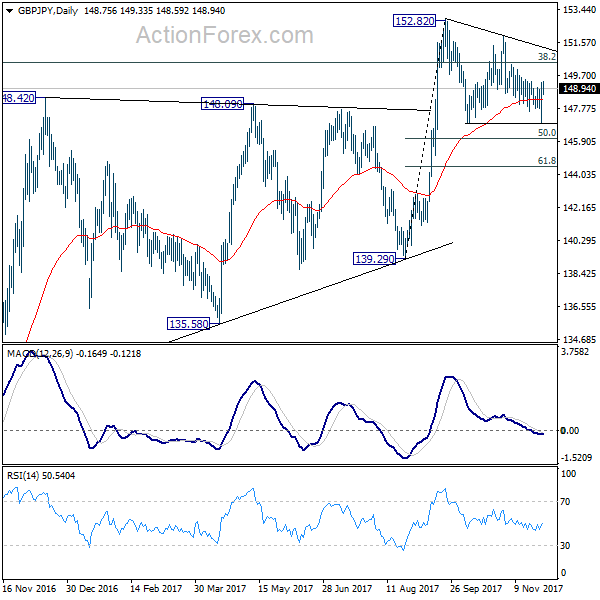

Outlook in GBP/JPY is unchanged that price actions from 152.82 are forming a corrective pattern. On the upside, above 149.45 will turn bias to the upside for 151.92 resistance first. Break there will likely resume rise from 139.29 through 152.82 high. On the downside, below 146.96 will bring deeper fall. But now, we’d expect downside to be contained by 50% retracement of 139.29 to 152.82 at 146.05 to bring up trend resumption eventually.

In the bigger picture, medium term rebound from 122.36 is still expected to resume after corrective pull back from 152.82 completes. Firm break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. In that case, GBP/JPY could target 61.8% retracement at 167.78. However, break of 139.29 will indicate rejection from 150.43 key fibonacci level. And the three wave corrective structure of rebound from 122.36 will argue that larger down trend is resuming for a new low below 122.26.