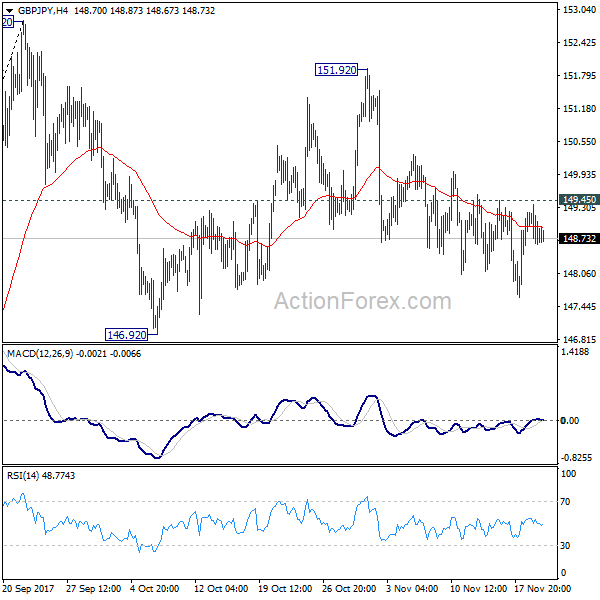

Daily Pivots: (S1) 148.51; (P) 148.93; (R1) 149.26; More…

GBP/JPY’s corrective pattern from 152.82 is still in progress. Deeper fall could be seen through 146.92 support. But we’d expect strong support from 61.8% retracement of 139.29 to 152.82 at 144.45 to contain downside and bring rebound. On the upside, break of 149.45 minor resistance will turn bias back to the upside for 151.92/152.82 resistance zone.

In the bigger picture, medium term rebound from 122.36 is still expected to resume after corrective pull back from 152.82 completes. Firm break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. In that case, GBP/JPY could target 61.8% retracement at 167.78. However, break of 139.29 will indicate rejection from 150.43 key fibonacci level. And the three wave corrective structure of rebound from 122.36 will argue that larger down trend is resuming for a new low below 122.26.