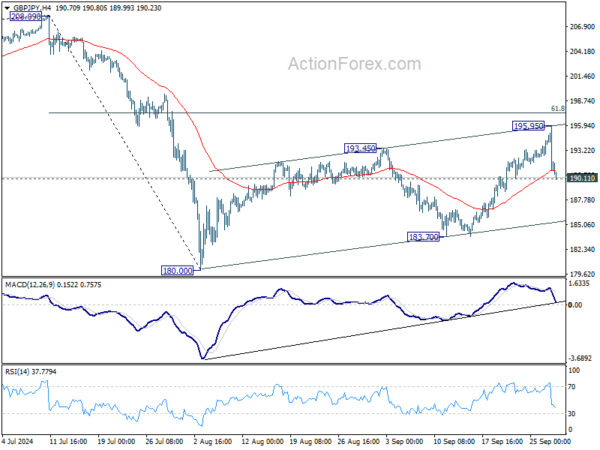

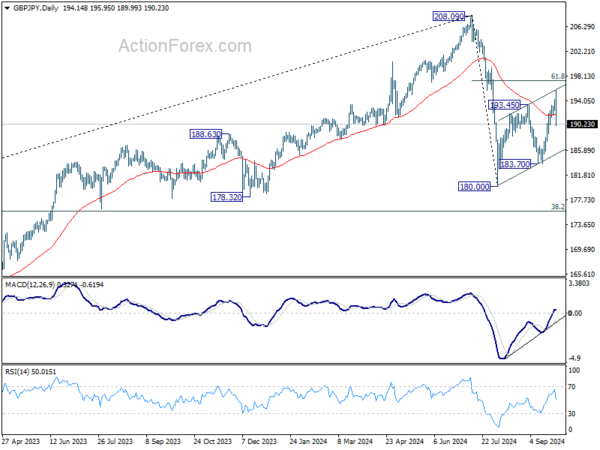

GBP/JPY retreated sharply after edging higher to 195.95 last week and initial bias is neutral this week first. On the upside, above 195.95 temporary top will extend the corrective rebound from 180.00 to 61.8% retracement of 208.09 to 180.00 at 197.35 next. However, firm break of 190.11 will argue that this correction might have completed, and turn bias back to the downside for 183.70 support next.

In the bigger picture, price actions from 208.09 are seen as a correction to whole rally from 123.94 (2020 low). The range of consolidation should be set between 38.2% retracement of 123.94 to 208.09 at 175.94 and 208.09. However, decisive break of 175.94 will argue that deeper correction is underway.

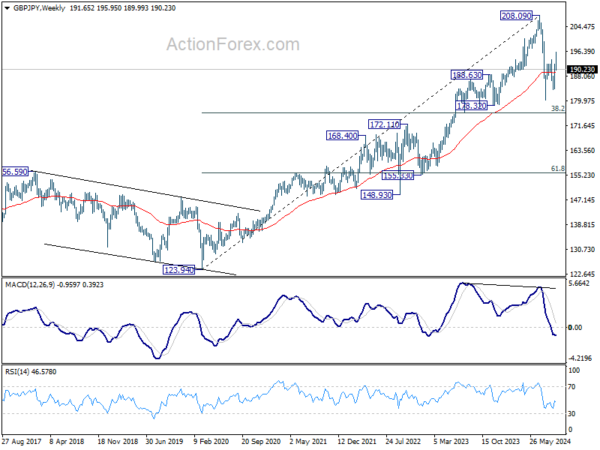

In the longer term picture, considering bearish divergence condition in W MACD, 208.09 is at least a medium term top. It’s still early to conclude that the up trend from 122.75 (2016 low) has completed. But it’s at least in a medium term corrective phase, with risk of correction to 55 M EMA (now at 170.18).