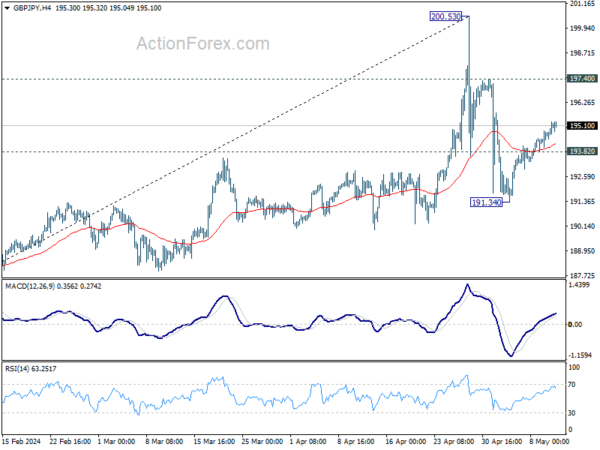

GBP/JPY’s rebound last week suggests that pullback from 200.53 has completed at 191.34 already. It’s now in the second leg of the corrective pattern from 200.53. Initial bias stays mildly on the upside this week for 197.40 resistance. On the downside, break of 193.82 will suggest that the third leg has started, and turn bias to the downside for 191.34 support.

In the bigger picture, a medium term top could be in place at 200.53 after breaching 199.80 long term fibonacci level. As long as 55 W EMA (now at 183.41) holds, fall from there is seen as correcting the rise from 178.32 only. However, sustained break of 55 W EMA will argue that larger scale correction is underway and target 178.32 support.

In the longer term picture, rise from 122.75 (2016 low) is seen as the third leg of the pattern from 116.83 (2011 low). Focus is now on 61.8% retracement of 251.09 (2007 high) to 116.83 at 199.80. Decisive break there would pave the way back to 251.09 in the long term