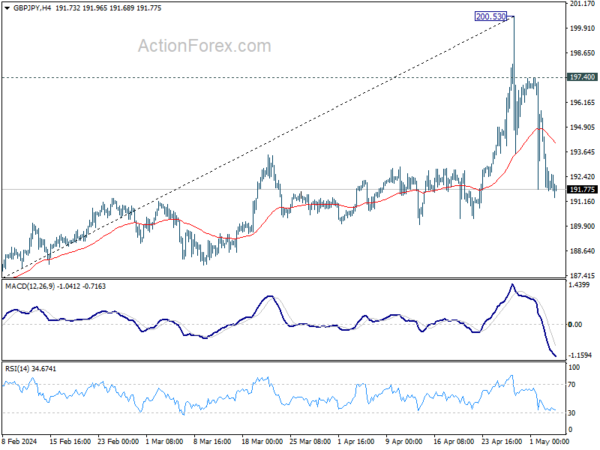

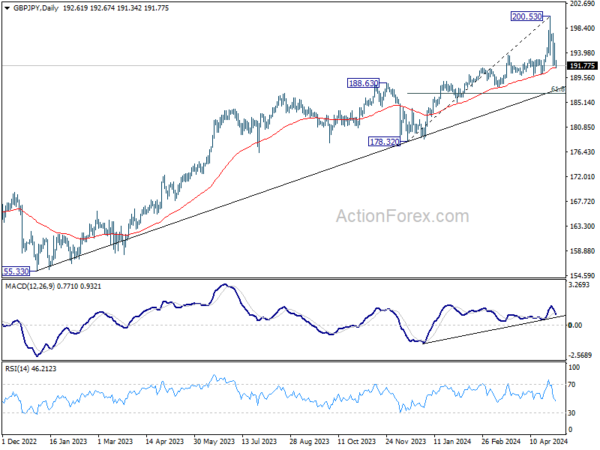

GBP/JPY reversed after rising to 200.53 last week and fell sharply since then. Initial bias remains on the downside this week. Sustained break of 55 D EMA (now at 191.34) will extend the fall from 200.53, to 61.8% retracement of 178.32 to 200.53 at 186.80. On the upside, break of 195.73 minor resistance will turn intraday bias neutral.

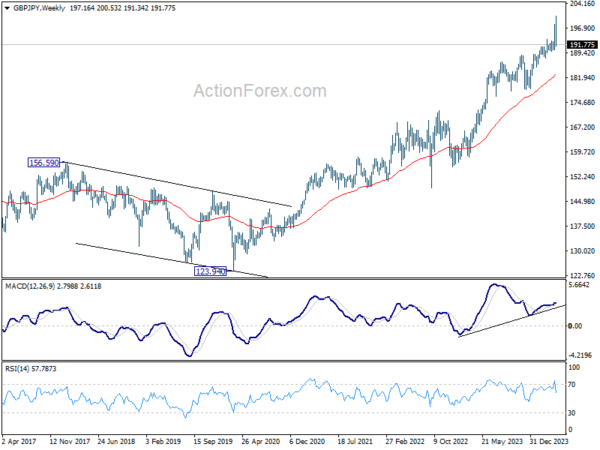

In the bigger picture, a medium term top could be in place at 200.53 after breaching 199.80 long term fibonacci level. As long as 55 W EMA (now at 182.98) holds, fall from there is seen as correcting the rise from 178.32 only. However, sustained break of 55 W EMA will argue that larger scale correction is underway and target 178.32 support.

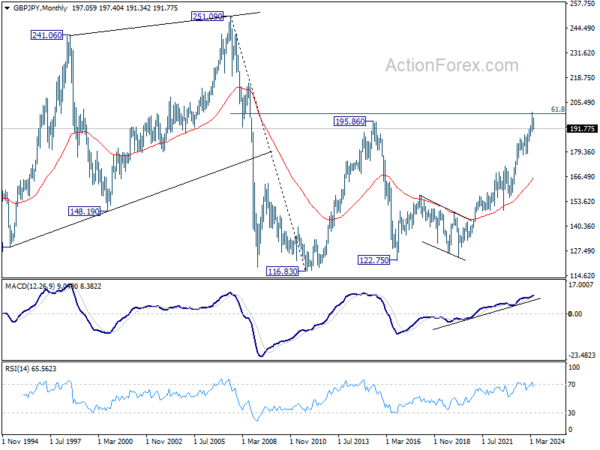

In the longer term picture, rise from 122.75 (2016 low) is seen as the third leg of the pattern from 116.83 (2011 low). Focus is now on 61.8% retracement of 251.09 (2007 high) to 116.83 at 199.80. Decisive break there would pave the way back to 251.09 in the long term.