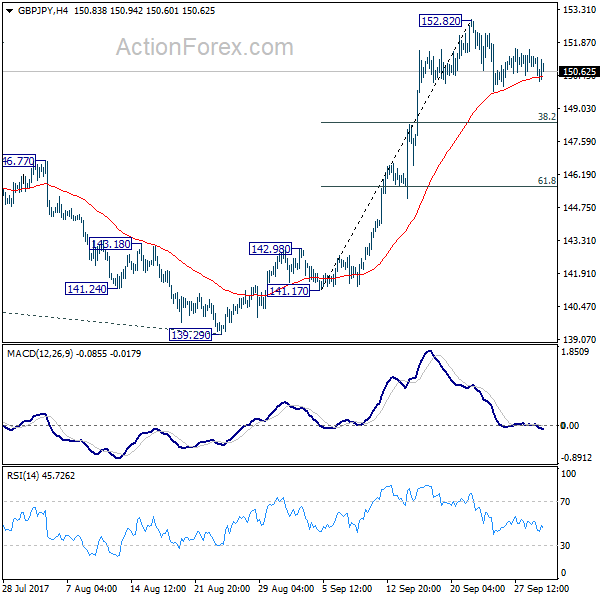

GBP/JPY stayed in consolidation from 152.82 short term top last week and outlook is unchanged. Initial bias remains neutral this week first. In case of another fall downside should be contained above 146.57 support to bring another rally. Break of 152.82 will extend the larger rise from 122.36 to 61.8% projection of 122.36 to 148.42 from 139.29 at 155.39 next.

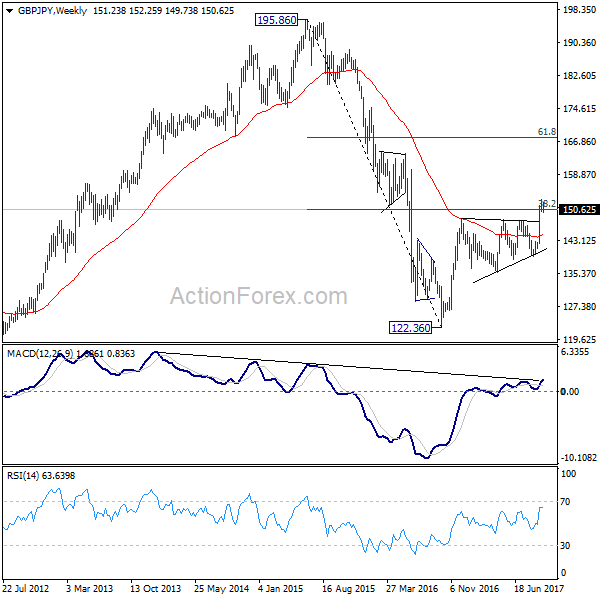

In the bigger picture, medium term rebound from 122.36 is in progress. Firm break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. In that case, GBP/JPY could target 61.8% retracement at 167.78. For now, the bullish scenario is preferred as long as 139.29 support holds.

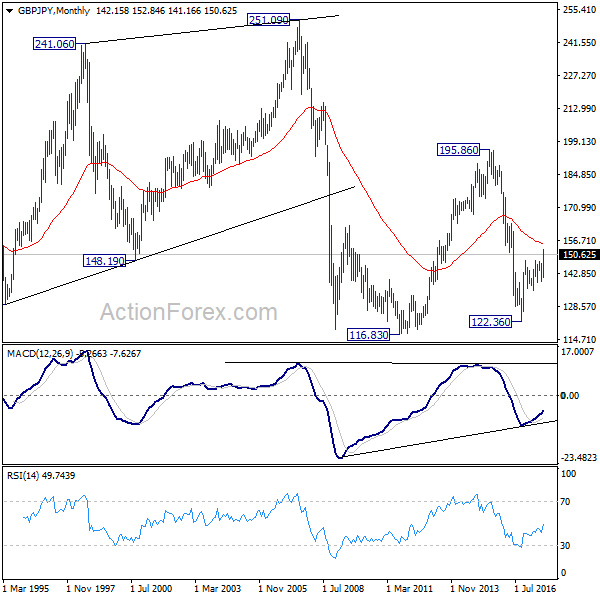

In the longer term picture, current decline argues that the down from fro 195.86 (2015 high) has already completed at 122.36. Focus is now on 55 month EMA (now at 155.14). Firm break there will suggest that rise form 122.36 is developing in to a long term move that target 195.86 again. And, price actions from 116.83 (2011 low) is indeed a sideway pattern that could last more than a decade.