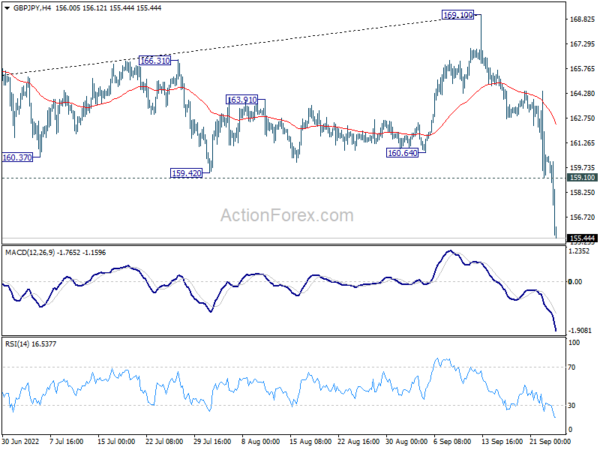

GBP/JPY’s sharp decline and break of 155.57 support suggests medium term topping at 169.10. That came after multiple rejection by long term fibonacci level at 167.93. Initial bias remains on the downside this week for 150.95 support next. On the upside, above 159.10 minor resistance will turn intraday bias neutral and bring consolidations, before staging another fall.

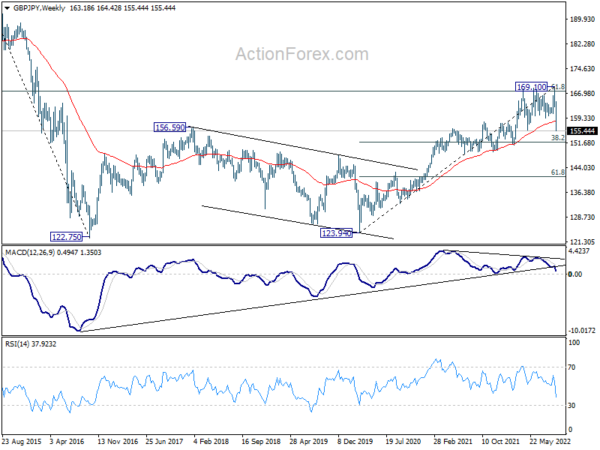

In the bigger picture, rejection by 61.8% retracement of 195.86 (2015 high) to 122.75 (2016 low) at 167.93 suggests that rise from 123.94 (2020 low) has completed. Deeper fall would be seen to 38.2% retracement of 123.94 to 169.10 at 151.84. Some support could be seen there to bring rebound. But risk will now stay on the downside as long as 169.10 resistance holds. Sustained trading below 151.84 will target 61.8% retracement at 141.19.

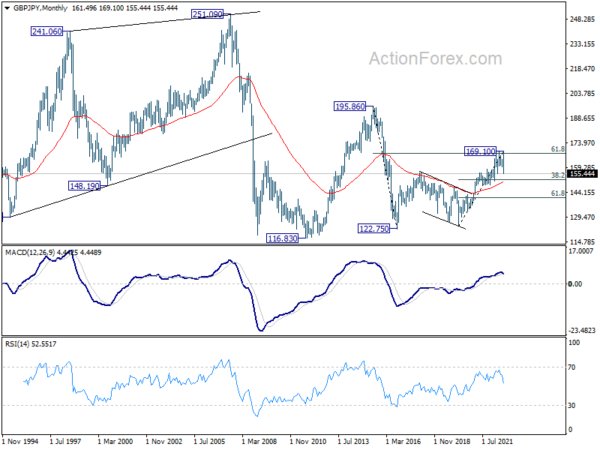

In the longer term picture, as long as 55 month EMA (now at 150.40) holds, rise from 122.75 could still extend higher at a later stage. However, sustained break of 55 month EMA will ague that whole rise has completed, and open up deeper fall back to 116.83/122.75 support zone.