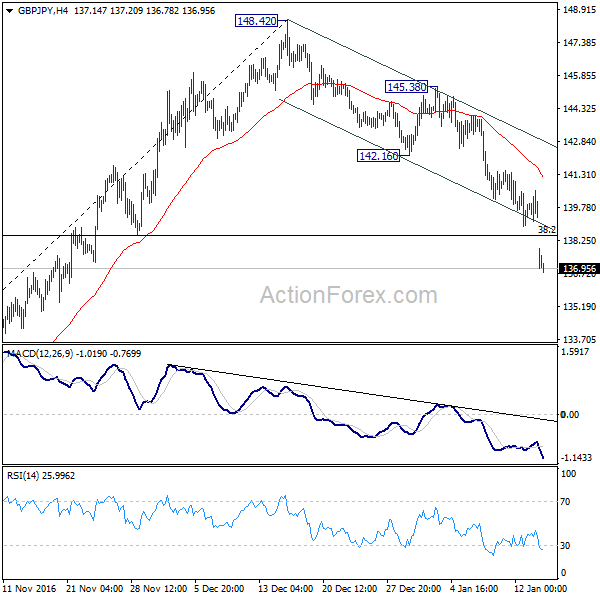

Daily Pivots: (S1) 138.89; (P) 139.73; (R1) 140.39; More…

GBP/JPY’s decline from 148.20 accelerated by breaking the channel line decisively. 38.2% retracement of 122.36 to 148.42 at 138.46 was also taken out firmly. The development suggests that whole corrective rise from 122.36 has completed at 148.42. Intraday bias stays on the downside for 61.8% retracement at 132.31 and below. On the upside, break of 142.16 support turned resistance is needed to indicate completion of such decline. Otherwise, outlook will stay bearish in case of recovery.

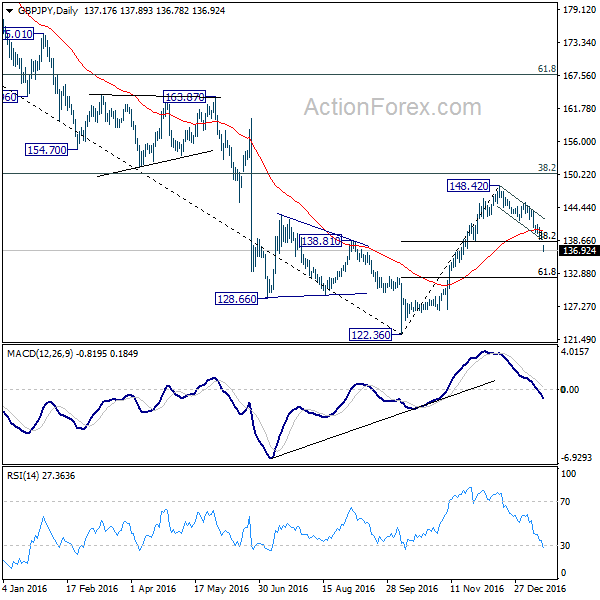

In the bigger picture, price actions from 122.36 medium term bottom are seen as developing into a corrective pattern. Upside is so far limited by 38.2% retracement of 195.86 to 122.36 at 150.4 for setting the medium term range. At this point, we don’t expect a break of 122.36 in near term and the corrective pattern would extend for a while.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box